Tax Harvesting

Tax harvesting is a strategy that can be used to help clients minimize the amount of taxes they are required to pay on capital gains or regular income.

Tax harvesting is a strategy used to help clients minimize the amount of taxes they are required to pay on capital gains or regular income.

What if you could realize losses on some of your client’s investments in order to offset other capital gains taxes they are required to pay? Luckily, every financial firm and advisor can do this, in the form of tax harvesting.

Tax harvesting comes in two forms, tax-loss, and tax-gain harvesting. The purpose of the sale informs the type of harvesting you are doing. Both strategies are beneficial to clients, advisors, and firms.

It is imperative to have a complete tax harvesting solution that goes in both directions and considers all taxable and non-taxable accounts.

Creating a Tax Harvesting Strategy

Tax harvesting is likely something your clients know nothing about unless they have encountered it before. As an expert advisor at a firm that manages a client’s complete financial portfolio and distributions, it is your responsibility to do what is ethically right for your client and their financial situation.

What is the Difference Between Tax-Loss Harvesting and Tax-Gain Harvesting?

Tax-loss harvesting is the process of selling a client’s stocks, ETFs, mutual funds, or other securities at a loss to offset the gains realized when selling other investments. Tax-gain harvesting is the opposite, where your advisors sell the investments to realize a capital gain.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy used in investment management to reduce taxes by selling securities that have experienced a loss. The purpose is to offset capital gains realized from the sale of other investments and potentially lower the overall tax liability.

Process of Tax-Loss Harvesting

The process of tax-loss harvesting involves identifying portfolio investments that have declined in value since their purchase. These investments are then sold at a loss, generating a capital loss that can be used to offset capital gains realized from the sale of other securities. The losses can also be used to offset up to $3,000 of ordinary income per year, with any remaining losses carried forward to future years.

Benefits of Tax-Loss Harvesting

The main benefit of tax-loss harvesting is the potential reduction of tax liability. By offsetting gains with losses, investors can lower their taxable income and, consequently, their tax bill. This strategy is particularly useful for high-income individuals or those with substantial capital gains. Tax-loss harvesting can also be employed to rebalance a portfolio by selling underperforming investments and reinvesting in more promising ones.

Tax-Gain Harvesting

Tax-gain harvesting, on the other hand, is the opposite strategy of tax-loss harvesting. Instead of selling securities at a loss, the goal is to sell investments that have appreciated in value to realize a capital gain.

Process of Tax-Gain Harvesting

When employing tax-gain harvesting, advisors or investors identify securities in their portfolio that have increased in value. These investments are then sold, resulting in a capital gain. The purpose of tax-gain harvesting is to take advantage of favorable tax rates for long-term capital gains or to utilize tax exemptions or deductions available for certain investment types.

Benefits of Tax-Gain Harvesting

Tax-gain harvesting can offer several benefits. By intentionally realizing capital gains, investors can strategically manage their tax liability and take advantage of preferential tax rates. In some cases, individuals may be in a lower tax bracket or benefit from certain tax deductions, making it advantageous to sell appreciated investments. Additionally, tax-gain harvesting can be used as part of an estate planning strategy or to optimize the tax treatment of a portfolio.

Challenges Associated with Finding Tax-Loss and Tax-Gain Opportunities

The process of finding suitable tax-loss and tax-gain opportunities can present challenges for advisors or individuals attempting to implement these strategies.

Complexity and Data Management

Traditional tax-loss and tax-gain harvesting can be complex and time-consuming. Advisors often need to navigate multiple spreadsheets, accounts, and holdings to identify the specific trades that would be most beneficial. This requires intricate calculations, formulas, and macros to determine the optimal transactions.

Identification of Opportunities

Identifying the most suitable investments for tax-loss or tax-gain harvesting can be a challenging task. Determining which securities have the potential for losses or gains and aligning them with individual tax situations requires careful analysis and consideration. Moreover, different investment types may have varying tax implications, further complicating the process.

Managing Multiple Clients

For advisors with multiple clients, the challenge is multiplied. Handling tax-loss and tax-gain harvesting across various accounts and portfolios can be time-consuming and labor-intensive. It may take days or even weeks to navigate through the necessary data, analyze opportunities, and execute trades for numerous clients effectively.

Traditional harvesting is a tedious process. Many advisors are required to use multiple spreadsheets for accounts and holdings, requiring complex formulas and macros to identify and organize specific trades. Additionally, identifying the most appreciated tax lots for gift-giving or what to sell to counteract losses can be a difficult task. Doing this across books for numerous clients can take days or even weeks to accomplish.

What is the solution for firms and advisors?

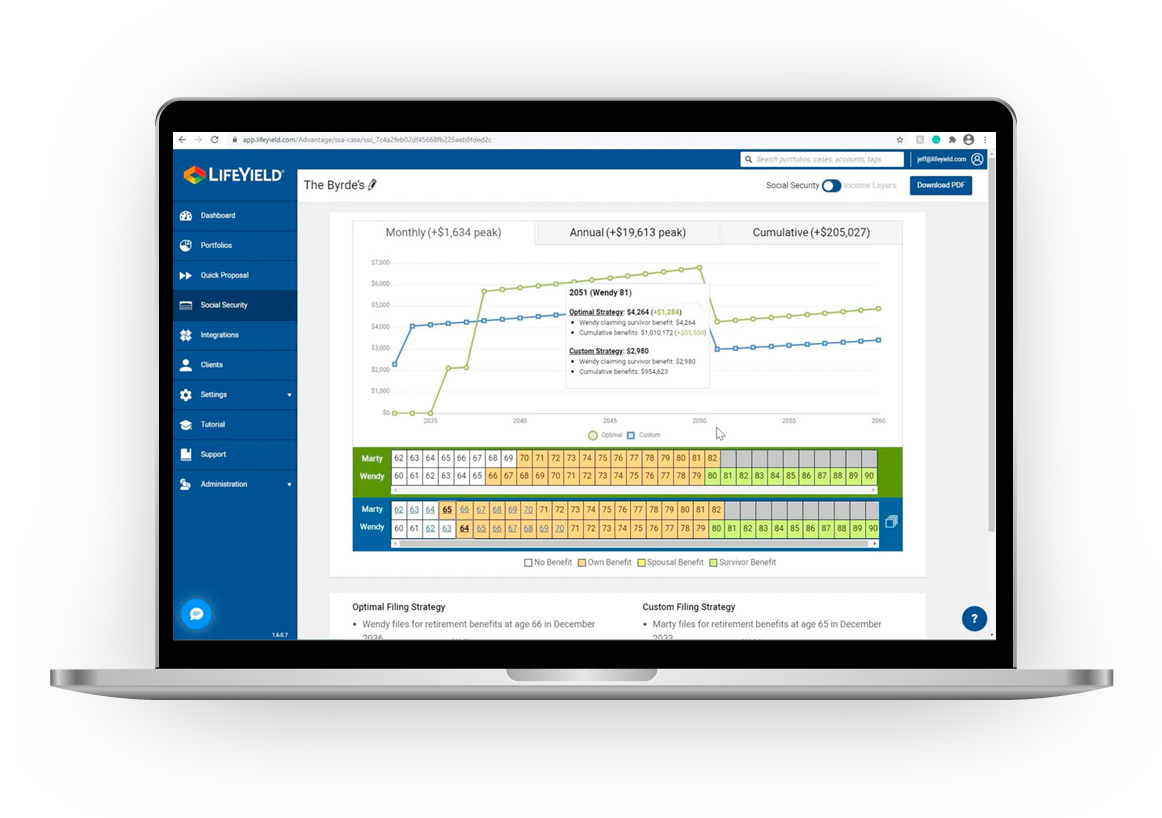

SEI LifeYield has the solution for firms and advisors to quickly and efficiently identify the potential for tax-loss and tax-gain harvesting. With their proprietary technology, SEI LifeYield can instantly pinpoint all available opportunities for harvesting gains and losses across client accounts in any given scenario.

SEI LifeYield Tax Harvesting works with SEI LifeYield’s asset location, rebalancing, and multi-account withdrawal engines to help firms tap into all areas of tax efficiency at scale.

What The Tax Harvesting Engine Does

SEI LifeYield’s proprietary tax harvesting engine assesses various scenarios to determine loss and gain opportunities for individual and unified managed household portfolios.

The tax harvesting engine scans and analyzes the holdings within a portfolio, which encompasses all relevant accounts, such as taxable investment accounts, retirement accounts, and more. By considering the entire portfolio, the engine can identify opportunities for harvesting losses and gains across different accounts, even when held by different individuals in a household.

-

Harvest Direction

While tax-loss harvesting is commonly used to offset capital gains or income, tax-gain harvesting can also serve a purpose. Tax-gain harvesting involves identifying investments in a portfolio that have appreciated in value and strategically selling them to realize a capital gain. This strategy can be particularly useful when looking to identify the highest appreciated tax lots for purposes such as gifting or charitable donations, or when an investor simply has a preference to offset realized losses with gains at the end of a tax year. SEI LifeYield’s Tax Harvesting Engine makes this process easy for advisors and their clients.

-

Holding Period

Investment portfolios typically comprise numerous tax lots that were purchased at different times and costs, leading to decisions regarding short-term versus long-term gain realization when harvesting for tax purposes, especially when considering the applicable tax rates. SEI LifeYield supports gain or loss harvesting for short-term or long-term tax lots individually, or across tax lots of any holding period. In all cases, any tax cost for the sold tax lots is minimized, and the tax benefit maximized.

-

Maximum Gain or Loss

SEI LifeYield allows a maximum gain or loss to be specified, which can limit the amount of tax harvesting that occurs. This strategy is particularly useful when seeking to offset a specific gain or loss amount, such as when a client has net realized gains during a tax year and wants to offset those gains with losses to eliminate the associated tax liability.

-

Maximum Proceeds

By having the ability to set a maximum proceeds limit, investors or advisors can control the total value of the sales suggested by the tax harvesting process. In addition, SEI LifeYield allows for more precise control over the transaction size by allowing minimum trade constraints to be set by value or quantity.

-

Avoids Wash Sales

Wash sales occur when a sale at a loss in a taxable account coincides with the recent purchase of the same security in any other household account. SEI LifeYield examines both taxable and non-taxable accounts to identify potential wash sale conditions. Advisors have the option to either avoid the wash sale or allow it to happen, with the assumption that the account manager will adjust the cost basis accordingly.

What is a Wash Sale?

The wash-sale rule, established by the IRS, is designed to prevent taxpayers from artificially creating losses for tax purposes. A wash sale is a transaction where an investor sells a security at a loss and repurchases the same or substantially identical security within a specific timeframe.

Under the wash-sale rule, if an investor sells a security at a loss and then buys it back within 30 days before or after the sale, the loss cannot be recognized for tax purposes. This means that the investor cannot deduct the loss from their taxable income. Instead, the cost basis of the repurchased security is adjusted to include the disallowed loss.

The purpose of the wash-sale rule is to prevent individuals from selling securities to create the appearance of a loss for tax purposes while retaining an economic interest in the same investment. By disallowing the recognition of losses in these situations, the IRS aims to ensure that taxpayers do not manipulate their taxable income through artificial transactions.

Wash Sale Example

Here is an outline of how a wash sale works:

When there are multiple accounts managed by different firms, the potential risk of wash sales becomes more apparent.

Firm 1 handles three investment accounts:

- XYZ: 100 shares

- ABC: 57 shares

- GHI: 150 shares

Firm 2 handles two more accounts:

- CDE: 125 shares

- FGH: 75 shares

On December 15, Firm 1 sells 100 shares of XYZ to harvest the loss for tax purposes. On December 28, Firm 2 sees an opportunity to purchase stock at a low rate and acquires 100 shares of XYZ.

Firm 1 tries to realize the loss from XYZ at tax time, but it is rejected because Firm 2 bought the stock within 30 days for the same client. Due to this, the firm cannot realize that loss, and it is considered a wash sale.

Challenges Associated with Wash Sales

One challenge associated with avoiding wash sales is the lack of communication between different investment accounts or portfolio management. If an investor sells a security at a loss in one account and then unknowingly repurchases the same or similar security in another account within the 30-day window, a wash sale can occur. This can result in the disallowance of the loss for tax purposes.

Complying with the wash-sale rule requires careful monitoring of transactions and coordination between different accounts or portfolio managers to ensure that repurchases do not occur within the prohibited timeframe. By understanding and adhering to the wash-sale rule, investors can ensure that their tax reporting remains accurate and compliant with IRS regulations.

The Best Time for Investment Tax-Loss Harvesting

The best time for tax-loss harvesting is when it helps improve outcomes for your client and helps them keep more of what they’ve earned. If your firm doesn’t have the technology to scan all accounts within a client’s unified managed household, tax harvesting can become a time-consuming process. Without the right technology, tax harvesting can add significant work to a fairly simple transaction.

One opportune time when tax harvesting is particularly useful is when clients are planning to take a distribution or execute a strategic withdrawal. By strategically harvesting losses before such transactions, clients can offset gains and potentially reduce their tax liability. This can be especially beneficial when clients have substantial capital gains that they want to offset or when they anticipate being in a higher tax bracket in the current year.

Conducting tax-loss harvesting without the proper technology can be a time-consuming process, especially if the advisor needs to manually review multiple accounts within a client’s unified managed household. Without the right tools, tax harvesting can add significant complexity and workload to what could otherwise be a straightforward transaction.

SEI LifeYield simplifies the process of harvesting gains and losses by doing it automatically. It scans all accounts, taxable and non-taxable, to identify the optimal opportunities for tax harvesting during any transaction. Whether it’s rebalancing or making a withdrawal, SEI LifeYield can efficiently perform tax harvesting while ensuring portfolio optimization.

By using SEI LifeYield’s technology, advisors can save time and effort while maximizing the tax benefits for their clients. The automated scanning and identification of tax harvesting opportunities streamline the process and enable advisors to implement tax-efficient strategies more effectively.

The best time for investment tax-loss harvesting is when it aligns with the client’s goals and offers the opportunity to improve outcomes. SEI LifeYield’s technology simplifies the process by automatically identifying optimal tax-loss harvesting opportunities, making it more efficient for advisors to implement tax-efficient strategies during various transactions.

How will your firm benefit from using the SEI LifeYield Tax Harvesting engine?

- You can keep your current technology: SEI LifeYield Tax Harvesting can act as an overlay to your current technology and enhances your firm’s modern tax efficiency capabilities.

- Limit capital gains for your clients: You can help your clients offset short-term and long-term capital gains with automatic tax-loss harvesting. SEI LifeYield can account for and prioritize both short-term and long-term.

- Identify appreciated lots for your clients: Sell winning investments to realize gains for clients. Use this to find the most appreciated assets for gift-giving or charitable donations.

Avoid wash sales: SEI LifeYield lets advisors scan both taxable and non-taxable accounts across the entire household to reduce the occurrence of wash sales.

The SEI LifeYield Tax Harvesting engine works with the other proprietary technology available to help firms and advisors provide quality and tax efficiency for advisors implementing unified managed households.

The SEI LifeYield Technology Library

The SEI LifeYield Library of Technology gives firms and advisors an advantage when handling clients’ investment accounts. Recognizing that the optimal approach to managing each client’s finances is not always uniform, the library acknowledges the uniqueness of each portfolio. No two portfolios are identical, and all scenarios possess distinct qualities and requirements.

SEI LifeYield uses a mindset and mission called “householding” as a basis for our technology.

Householding is the practice of strategically managing and coordinating all of a client’s accounts and holdings to maximize after-tax returns. It involves taking the asset allocation approach to the household level instead of managing individual accounts separately. SEI LifeYield’s goal is to optimize the overall investment strategy for the client’s entire household portfolio.

When implemented effectively, each account within the portfolio will have a unique composition. The assets held in a Roth IRA will differ significantly from those in a brokerage account. This intentional variation is due to the different tax treatments associated with each account type throughout the portfolio. Optimal tax efficiency requires placing each asset in the most appropriate account, ensuring that there is a correct allocation for every asset within the portfolio.

Asset Location

Asset location is a strategy that determines the optimal placement of money in various accounts to minimize taxes. Unlike asset allocation, which focuses on the allocation of funds within a portfolio, asset location specifically targets locations that offer the best tax optimization strategy.

SEI LifeYield Asset Location provides advisors and their clients with a powerful tool to reduce unnecessary taxes, ultimately resulting in higher retained assets and increased retirement income. The integration of SEI LifeYield’s Asset Location Score simplifies tax-related discussions by providing a score that ranges from 0 to 100, indicating the level of tax efficiency in the portfolio.

The SEI LifeYield Asset Location Score provides an easy-to-digest metric that clients can easily understand. It quantifies the benefits in dollars associated with each recommended action, enabling clients to fully grasp the impact of their advisor’s decisions. This transparency transforms what used to be a mysterious process for advisors into a distinct competitive advantage.

Based on the Asset Location Score, the SEI LifeYield engine generates actionable recommendations to improve the score and enhance tax efficiency within the portfolio. These recommendations can include adjustments such as shifting investments between taxable and tax-advantaged accounts, considering the tax implications of specific asset types, or optimizing distributions in retirement.

The inclusion of the Asset Location Score adds a level of transparency and simplicity to the tax optimization process. Clients can easily understand the score and its implications, as it quantifies the benefits in dollars associated with each recommended action. This enables clients to grasp the impact of their advisor’s decisions on their tax situation and overall financial well-being.

For advisors, the SEI LifeYield platform and Asset Location Score provide a distinct competitive advantage. By offering a clear and tangible measure of tax efficiency, advisors can showcase the value they bring to clients’ financial goals and differentiate themselves in the marketplace. The transparent and actionable nature of the Asset Location Score helps advisors build trust and demonstrate the benefits of tax optimization strategies.

Asset location is a tax optimization strategy that focuses on placing money in the most tax-efficient locations within a portfolio. SEI LifeYield’s Asset Location tool and the Asset Location Score empowers advisors to provide tailored recommendations, reduce taxes, and enhance client outcomes.

Tax-Smart Withdrawals

SEI LifeYield’s tax-smart withdrawal engine minimizes the tax burden for clients by selecting the most advantageous accounts to withdraw from across their entire household portfolio. This technology eliminates the need for complex calculations and analyses, streamlining the process of fund withdrawals and making it more efficient for both advisors and clients.

The tax-smart withdrawal engine takes into account all accounts within the client’s portfolio, including taxable and tax-advantaged accounts. By considering the unique tax characteristics of each account and the client’s specific tax situation, the technology optimizes the selection of assets to withdraw. This optimization aims to minimize tax consequences and maximize after-tax returns for the client.

One key benefit of the tax-smart withdrawal engine is its ability to address portfolio drift. Over time, investment portfolios may deviate from their target asset allocation due to market movements. When making withdrawals, the engine strategically selects assets that help rebalance the portfolio back to its desired allocation, thus minimizing drift and keeping the portfolio on track.

Furthermore, the engine considers the tax implications of gains and losses within the portfolio. It identifies opportunities to offset gains with losses or strategically realize gains in a tax-efficient manner. By doing so, the technology helps clients reduce their overall tax liability and retain more of their investment gains.

Using SEI LifeYield’s tax-smart withdrawal engine, advisors and clients can benefit from a simplified and efficient process of fund withdrawals. The engine’s optimization strategies help minimize taxes, reduce portfolio drift, and make strategic decisions about asset selection.

Multi-Account Rebalancing

Regular multi-account rebalancing is essential to maintain portfolios alignment with the desired asset allocation – particularly after withdrawals, to preserve clients’ investment objectives and risk profiles.

When conducting a rebalance, SEI LifeYield goes beyond simply realigning the portfolio’s asset allocation. It also evaluates the tax implications of the rebalancing actions. By considering the tax efficiency of the entire household, including taxable and tax-advantaged accounts, the rebalancing process aims to optimize tax outcomes while maintaining the desired asset allocation.

SEI LifeYield’s rebalancing strategies can be seamlessly combined with tax harvesting and asset location strategies. By integrating these approaches, advisors can further enhance the tax efficiency of the portfolio. Tax harvesting can be performed alongside rebalancing, allowing for the identification of opportunities to sell securities at a loss to offset gains or reduce taxable income. Asset location considerations can also be taken into account during the rebalancing process, ensuring that assets are placed in the most advantageous accounts from a tax perspective.

By incorporating tax efficiency into the rebalancing process, SEI LifeYield enables advisors to achieve optimal results for their clients. The combined strategies of rebalancing, tax harvesting, and asset location work in harmony to maintain the desired asset allocation, minimize tax liabilities, and enhance overall portfolio performance.

Why Tax Harvesting Sets Clients Up For Success

Tax harvesting enables clients and their advisors to make tax-efficient decisions for each investment, recognizing that what works for one account may not be suitable for another. With dynamic market conditions, it can be challenging for firms and advisors to stay updated on tax laws and relevant information. SEI LifeYield Tax Harvesting provides a framework to navigate this uncertainty and take control over outcomes.

Taxes represent the largest drag on investment returns While market performance is beyond their control, advisors can optimize tax outcomes by strategically placing holdings, rebalancing efficiently, and identifying tax harvesting opportunities. By doing so, they can enhance long-term returns for clients.

The success of an investment account is tied to the success of the entire household portfolio, encompassing various assets and retirement accounts. Managing the household as a whole, rather than individual accounts, is crucial for a winning strategy.

Traditional tax harvesting technology typically focuses on individual accounts and lacks the ability to work at the household level. However, with advancements such as SEI LifeYield Tax Harvesting, advisors now have access to technology that can optimize tax outcomes across the entire household portfolio. This holistic approach ensures that all accounts work together in a coordinated manner, maximizing tax efficiency and overall investment success.

By leveraging comprehensive tax harvesting solutions like SEI LifeYield, advisors can effectively navigate the complexities of tax management, optimize outcomes for clients, and create a winning investment strategy that encompasses the entire household portfolio.

Choosing SEI LifeYield Tax Harvesting For Your Firm

Choosing SEI LifeYield’s Tax Harvesting solution for your firm offers numerous benefits and addresses the challenges associated with traditional tax harvesting methods.

Offsetting income or capital gains has long been a tedious process, typically involving multiple spreadsheets of accounts and holdings running through complex formulas and macros to identify and organize meticulous trades. This process can be error-prone and labor-intensive, requiring several days or even weeks to execute for a book of clients. SEI LifeYield’s Tax Harvesting Engine streamlines this process by instantly identifying and utilizing all opportunities to harvest gains and losses across a client’s accounts and holdings.

SEI LifeYield’s Tax Harvesting Engine goes beyond the basic offsetting of gains and losses. It integrates seamlessly with SEI LifeYield’s other tax efficiency APIs, allowing for the generation of tax alpha for clients. This means that the technology not only helps to minimize tax liabilities but also actively enhances after-tax returns for clients, providing a competitive edge for your firm.

Additionally, SEI LifeYield is able to handle multiple accounts effortlessly. Traditional advisor technology platforms often lack the capability to accommodate multiple accounts within a unified managed household. However, SEI LifeYield’s technology is designed to handle the complexity of managing multiple accounts and provides a comprehensive solution for tax harvesting at scale. This scalability makes it an ideal choice for firms of any size, including the largest financial institutions in the world.

By choosing SEI LifeYield, your firm can benefit from a proven tax-efficient solution that solves complex challenges and delivers tangible results. The technology not only saves time and reduces manual effort but also enhances the overall tax efficiency and after-tax returns for clients. Whether you are a small advisory firm or a large financial institution, SEI LifeYield’s Tax Harvesting solution can help you optimize your tax strategies and provide value to your clients.

Selecting SEI LifeYield’s Tax Harvesting solution for your firm offers the advantages of streamlining the tax harvesting process, generating tax alpha for clients, and effortlessly handling multiple accounts. With its proven track record and ability to address complex tax efficiency challenges at scale, SEI LifeYield’s technology is a valuable tool for enhancing your firm’s tax optimization capabilities.

For educational purposes only. This information should not be considered investment advice.