Decumulation

You’ve helped your clients invest and save for retirement. What can your firm do now to guide clients on how to draw down on their assets and create a longer runway in retirement?

What is Accumulation? What is Decumulation?

One of the main reasons clients engage financial advisors is to help them invest in ways that will let them achieve their desired lifestyles in retirement. This is the “accumulation” phase of an investor’s life. Channeling income into taxable and tax-advantaged accounts and investments is critical to accumulation, but it’s only half the solution.

Once clients stop working, they enter a phase called “decumulation.” And many retirees will fail to harvest the full benefit of their accumulated wealth.

Accumulation Phase

Accumulation refers to the phase in financial planning when individuals actively save and invest their money with the goal of building wealth over time, typically for retirement. During this phase, clients hire financial advisors to provide investment guidance and help them achieve their desired retirement lifestyles.

During the accumulation phase, individuals focus on building and managing three types of wealth to maximize their retirement benefits:

Financial wealth: This includes the assets that individuals intentionally accumulate over time through various investment vehicles. It encompasses:

- Taxable accounts: These are investment and business assets held outside of tax-advantaged accounts. They can include stocks, bonds, real estate, mutual funds, ETFs, and other investments subject to capital gains taxes.

- Tax-deferred accounts: These are retirement accounts that offer tax advantages, such as 401(k)s, traditional IRAs, annuities, and employer-sponsored pensions. Contributions to these accounts are often tax-deductible, and taxes on earnings are deferred until withdrawal.

- Tax-exempt accounts: These are accounts that provide tax-free growth and withdrawals. Examples include Roth accounts (Roth IRAs and Roth 401(k)s), and cash-value life insurance policies with tax benefits.

- Tax-Exempt and Tax-Deferred Account:

Health savings accounts (HSAs) have a “triple-tax advantage.” Contributions up to limits set annually by the IRS are tax-free. Any growth – through interest or investments – and withdrawals are tax-free too as long as the money is used to pay for or reimburse one’s self for qualified medical expenses.

Retirement wealth: This refers to the present value, in today’s dollars, of an individual’s expected retirement cash flows. It includes income sources like Social Security benefits and defined benefit pension plans. Individuals can tap into these assets as a source of retirement income, similar to a nest egg.

Financial advisors work with clients to develop personalized investment strategies that align with their risk tolerance, time horizon, and financial goals. They may recommend a diversified portfolio of stocks, bonds, mutual funds, or other investment vehicles to optimize returns and minimize risks. Advisors may also help clients make informed decisions about contributing to retirement accounts, taking advantage of employer matching programs, and maximizing tax benefits.

Throughout the accumulation phase, advisors continuously monitor investment performance, rebalance portfolios as needed, and provide guidance on adjusting savings and investment strategies based on changes in clients’ financial circumstances or market conditions.

Net home equity: Leverage magnifies the return on a homeowner’s initial investment over an extended period. Home equity is measured by its current market value, less its outstanding mortgage debt. Reverse mortgages and downsizing strategies can convert the equity to income for retirement.

Decumulation Phase

The decumulation phase begins when an individual starts withdrawing or taking income from accumulated assets, usually when they decide to retire fully or partially from work. Unfortunately, retirees often struggle to fully leverage and harvest the full benefit of their accumulated wealth during this phase.

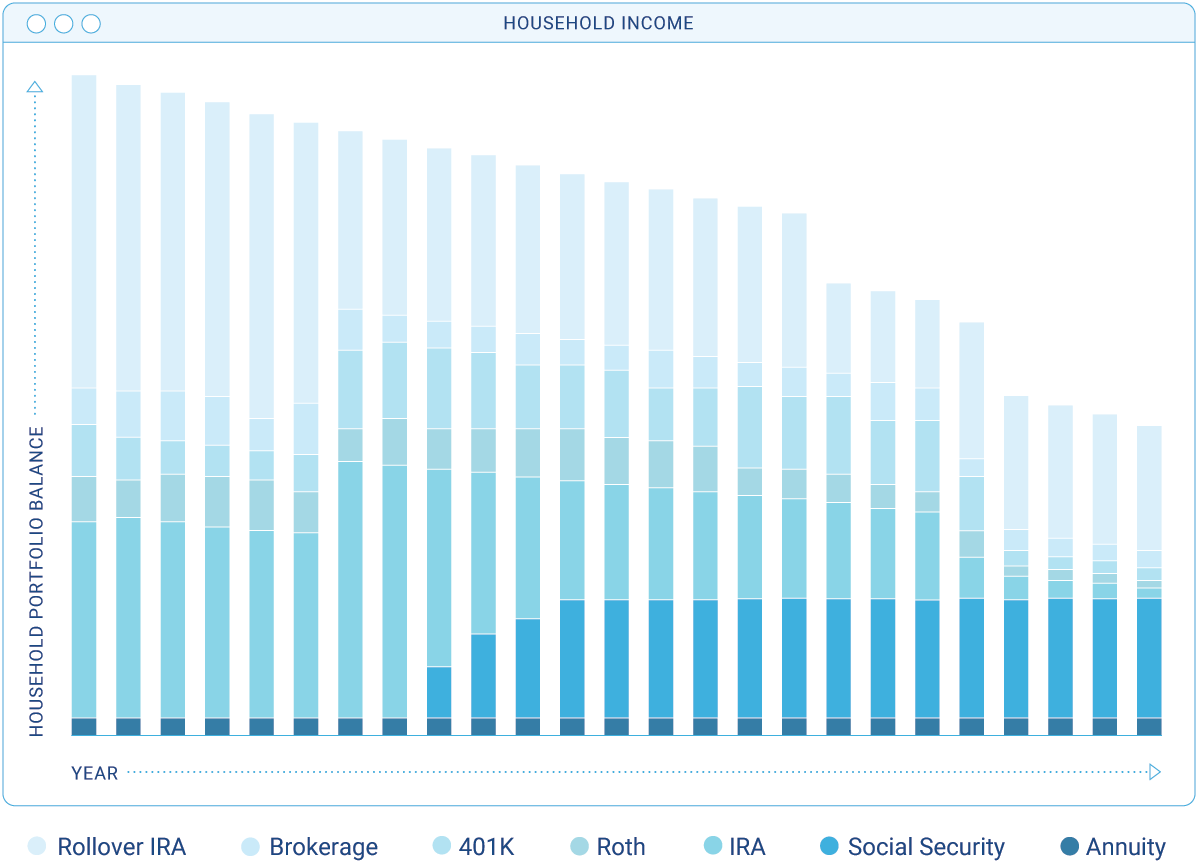

In the decumulation phase, retirees transition from saving and investing to generating income from their retirement assets to support their living expenses. They may rely on various sources of retirement income, such as Social Security benefits, pensions, annuities, and distributions from retirement accounts.

Old and outdated strategies for guiding clients in the decumulation phase involve withdrawing a percentage from all available invested assets annually (often 4%) or liquidating assets in a prescribed order of taxable assets followed by tax-deferred assets and then tax-free assets.

Both of these accumulation and decumulation approaches have a significant flaw – they overlook the impact of investment taxes on net returns in the accumulation and decumulation phases. SEI LifeYield provides financial firms with an API (advanced programming interface) library of solutions to minimize taxes on a household portfolio over time and optimize the timing of filing for Social Security benefits.

What Is Decumulation in Retirement?

Retirement decumulation involves turning accumulated assets into retirement income. Typically, the retirement decumulation phase begins with an event – retiring from work, transitioning to part-time employment, the death of a wage-earning spouse, or a divorce. These events require clients or households to liquidate assets for income and financial security.

During the retirement decumulation phase, retirees face several challenges that require careful planning and strategizing. One of the primary challenges is identifying the most tax-efficient ways to sell assets and make withdrawals. This involves considering the tax implications of different investment accounts and determining the optimal order in which to liquidate assets to minimize tax liabilities. Only an integrated set of strategies at the household level can meet these challenges and form a comprehensive and sustainable decumulation plan.

Coordinating asset sales with government benefits, such as Social Security, is another crucial aspect of decumulation. Retirees need to understand how their income from asset sales may affect their eligibility for and taxation of government benefits. Coordinating these sources of income ensures that retirees can maximize their overall retirement income while maintaining eligibility for important benefits.

Protecting wealth and retirement income from inflation is also a significant concern during decumulation. Retirees need strategies in place to ensure that their income keeps pace with the rising cost of living. This may involve investing in inflation-protected assets or utilizing strategies that adjust the withdrawal rate based on inflationary factors.

To address the challenges of decumulation, a comprehensive and sustainable plan is required at the household level. It involves integrating various strategies that consider tax efficiency, coordination with government benefits, and protection against inflation. Financial advisors play a vital role in helping retirees develop and implement such plans to ensure a financially secure retirement.

SEI LifeYield provides integrated retirement decumulation solutions that maximize post-tax retirement income without requiring technology replacement or new database development. SEI LifeYield’s tax-efficiency APIs can also be applied to assets that may not be under the direct management of an advisor but need to be factored into the overall decumulation and retirement security plan. By incorporating these solutions, advisors can offer comprehensive decumulation and retirement security planning to their clients.

What Is a Retirement Decumulation Strategy?

A retirement decumulation strategy is a personalized blueprint for systematically drawing down on a client’s assets over time. It must be tailored to clients’ (and their spouses’) individual circumstances and aim to achieve what retirees say they want most: confidence that they will not outlive their assets.

When developing a decumulation strategy, financial advisors engage in discussions with their clients to gather important information and make informed decisions. Some of the key topics that advisors will need to address during these conversations include:

Fixed Expenses

When developing a decumulation plan, it’s crucial to understand the clients’ fixed expenses. These are the essential expenses that individuals must cover to maintain their standard of living in retirement. By asking specific questions about fixed expenses, financial advisors can gather important information to determine the amount of income needed to meet these obligations. Some common fixed expenses include:

- Housing: This includes mortgage or rent payments, property taxes, homeowners or renters insurance, maintenance costs, and utilities.

- Food: The cost of groceries, dining out, and any dietary considerations or special food requirements should be taken into account.

- Insurance: This encompasses health insurance premiums, long-term care insurance, life insurance premiums, and any other insurance policies, such as homeowners insurance, the clients maintain.

- Utilities: Expenses for electricity, gas, water, internet, cable or satellite TV, and phone services fall under utilities.

- Transportation: This includes car loan or lease payments, fuel costs, auto insurance, maintenance and repairs, public transportation fares, and any other transportation-related expenses.

- Taxes: Clients may have ongoing tax obligations, such as property taxes or estimated tax payments, that need to be factored into their fixed expenses.

- Debt payments: If clients have any outstanding debt, such as credit card debt, student loans, or personal loans, the monthly payments should be accounted for.

- Other necessities: Essential items like clothing, personal care products, household supplies, and necessary services (e.g., home maintenance, cleaning, etc.) should also be considered.

Financial advisors can help ensure that clients’ decumulation plan accounts for these essential costs. This information allows for more accurate calculations of the income needed to cover these expenses and assists in designing a sustainable retirement income strategy.

Part-Time Work

Understanding if the clients plan to work part-time during retirement and for how long, as it can impact their income needs and the sustainability of their assets. The decision to continue working in some capacity can have significant implications for their overall financial picture and the sustainability of their assets. Here are some key points to consider:

- Additional income: Part-time work during retirement can provide clients with an additional source of income. This income can help supplement their retirement savings and reduce the amount of assets they need to draw down on each year. Understanding the client’s intentions regarding part-time work allows financial advisors to factor this income into their decumulation plan.

- Income needs: By knowing clients’ plans for part-time work, advisors can assess how much income they will require from their retirement savings. This information helps in determining the appropriate withdrawal rate from their assets and ensures that their income needs are met while considering the potential income from part-time work.

- Asset sustainability: Continuing to work part-time can extend the longevity of clients’ retirement savings. By reducing the reliance on withdrawals from their assets, they can preserve their savings for a longer period and potentially increase the overall sustainability of their financial plan.

- Social Security implications: Part-time work can also impact clients’ Social Security benefits. If they choose to work before reaching their full retirement age, their benefits may be subject to an earnings limit, which could temporarily reduce the amount they receive. Understanding clients’ part-time work plans allows advisors to coordinate the timing of Social Security filings to optimize benefits.

- Lifestyle considerations: Part-time work during retirement may also have an impact on a client’s desired lifestyle. It is essential to assess whether they have specific goals or plans that rely on the income generated from part-time work, such as travel, hobbies, or supporting family members.

Health Considerations

Discussions about any health issues or concerns that may affect the clients’ lifestyles or life expectancies are important, as that can influence their income requirements and potential medical expenses. Here are some key points to consider:

- Medical expenses: Health issues can lead to increased medical expenses during retirement. It is important to discuss a client’s current health status, any chronic conditions, and potential future healthcare needs. This information helps in estimating the costs associated with healthcare, including insurance premiums, deductibles, prescription medications, and long-term care expenses.

- Life expectancy: Health conditions can also impact life expectancy. Longer life expectancies necessitate a longer duration of retirement income, which requires careful planning to ensure that a client’s assets can sustain their lifestyle for the desired period. Understanding clients’ health concerns allows advisors to incorporate appropriate life expectancy estimates into their decumulation plans.

- Insurance coverage: Health considerations may also influence clients’ decisions regarding health insurance coverage during retirement. Advisors can discuss options such as Medicare, supplemental insurance policies, and long-term care insurance to ensure adequate coverage and protection against potential healthcare costs.

- Lifestyle adjustments: Health issues can lead to lifestyle adjustments, such as changes in spending patterns or the need for specialized care. These adjustments may impact clients’ income requirements and should be accounted for in the decumulation plan. Discussions about potential lifestyle changes due to health considerations can help advisors create a realistic and sustainable financial strategy.

- Legacy and estate planning: Health concerns can also influence clients’ priorities regarding legacy and estate planning. They may wish to allocate resources for medical expenses, long-term care, or leave a financial legacy for their heirs. Understanding their intentions allows advisors to incorporate these goals into the overall decumulation plan.

Discussing health issues and concerns with clients can help advisors gain a comprehensive understanding of their specific needs and tailor the decumulation plan accordingly. This ensures that potential medical expenses and lifestyle adjustments are accounted for, and the client’s income requirements are adequately addressed throughout their retirement years.

Housing Plans

Understanding clients’ housing plans is an important aspect of retirement decumulation planning. Exploring whether they intend to sell their home and downsize or relocate helps in assessing their housing expenses and available equity. Here are some points to consider:

- Downsize or relocate: Discussing clients’ housing plans allows you to understand if they have any intentions to downsize their current home or relocate to a different area. Downsizing or relocating can have financial implications as it may result in reduced housing expenses, lower property taxes, and potential equity release from home sales.

- Housing expenses: Depending on their housing plans, clients may experience changes in their housing expenses during retirement. Moving to a smaller home or a different location may result in reduced mortgage payments, property taxes, insurance costs, and maintenance expenses. On the other hand, if they plan to purchase a new property or move to a higher-cost area, their housing expenses may increase. Understanding these potential changes allows for more accurate budgeting and income planning.

- Home equity: Selling a home and downsizing or relocating can provide clients with additional home equity that can be used to supplement their retirement income or fund other financial goals. It is important to discuss the potential equity they may have available and how it can be utilized effectively within their decumulation plan.

- Lifestyle considerations: Housing plans can also be influenced by lifestyle preferences. Some clients may want to stay in their current home for sentimental or lifestyle reasons, while others may prefer a different living arrangement that better suits their retirement goals and aspirations. By discussing housing plans, you can align the decumulation strategy with their desired lifestyle choices.

- Housing alternatives: Apart from downsizing or relocating, clients may also consider other housing alternatives, such as purchasing a vacation home, joining a retirement community, or exploring rental options. These alternatives have different financial implications, including upfront costs, ongoing expenses, and potential rental income, which should be factored into the decumulation plan.

This information helps in creating a decumulation plan that aligns with their housing goals and ensures that their financial resources are optimally utilized in retirement.

Financial Support

Identifying if the clients expect to provide financial assistance to parents, children, or grandchildren, is an important aspect of retirement decumulation planning as it impacts their overall budget and income needs. Here are some points to consider:

- Parents: Clients may have aging parents who require financial assistance for healthcare expenses, long-term care, or general support. It’s important to discuss whether clients anticipate providing any financial help to their parents and to what extent. This can help determine the potential impact on their budget and the need for additional income or resources to support these obligations.

- Children: Clients may have children who are still financially dependent or may require assistance for education, housing, or other expenses. Discussing the clients’ expectations regarding financial support for their children can help in assessing the potential impact on their budget and the need to allocate resources accordingly. This includes considering any ongoing financial obligations, such as child support or college tuition.

- Grandchildren: Clients may also have grandchildren whom they wish to support financially, such as contributing to their education savings or providing financial gifts.

Understanding clients’ intentions in this regard can help in estimating the potential financial commitments and incorporating them into the decumulation plan. - Budget and income needs: Financial support provided to parents, children, or grandchildren can have a significant impact on clients’ overall budget and income needs during retirement. It’s important to quantify the potential financial obligations and consider them when determining the required income streams and asset allocation strategies. This may involve adjusting the planned withdrawal rates, considering the timing and amounts of financial support, and evaluating the sustainability of the decumulation plan.

- Balancing priorities: Providing financial support to family members is a personal decision that needs to be balanced with the client’s own financial security and retirement goals. Advisors can help clients navigate these considerations by discussing the trade-offs and potential alternatives, such as setting boundaries on support, exploring other forms of assistance (e.g., education savings plans), or collaborating with other family members to share responsibilities.

Advisors can gain a comprehensive understanding of their overall budget and income needs by identifying if clients expect to provide financial assistance to parents, children, or grandchildren. This information allows for more accurate planning and helps ensure that the decumulation strategy aligns with the client’s financial goals and priorities while considering their family obligations.

Legacy Goals

Discussing the clients’ desires for leaving legacies to their family or charitable organizations, is an important consideration as it affects their asset allocation and distribution strategies. Some key points to consider are:

- Family legacy: Clients may have specific goals and intentions for leaving a financial legacy to their family members, such as children, grandchildren, or other relatives. This can include providing an inheritance, funding education expenses, or supporting future generations. It’s important to have open discussions with clients about their desired legacy and the values they want to pass on to their families.

- Charitable giving: Some clients may have a strong desire to support charitable causes and organizations. They may wish to leave a portion of their assets as charitable donations or establish a charitable foundation or trust. Discussing their philanthropic goals and values can help shape the decumulation plan and incorporate strategies for charitable giving while optimizing their overall financial objectives.

- Estate planning: Legacy goals often intersect with estate planning considerations. Clients may have specific wishes regarding the distribution of their assets and the management of their estate after their passing. This may involve setting up trusts, naming beneficiaries, or utilizing estate planning tools to minimize taxes and ensure a smooth transfer of wealth to their chosen beneficiaries. Working in conjunction with an estate planning attorney can help address these aspects effectively.

- Balancing priorities: Leaving a legacy is a personal choice that needs to be balanced with other financial goals and considerations. It’s essential to help clients evaluate the potential trade-offs between providing for their own retirement needs and aspirations and leaving a meaningful legacy. This may involve discussing the optimal distribution of assets and exploring strategies to maximize the impact of their legacy while maintaining their financial security.

- Regular review and adaptation: Legacy goals may evolve over time, so it’s important to regularly review and update a decumulation plan accordingly. Clients’ circumstances, family dynamics, and charitable interests may change, necessitating adjustments to the planned legacy strategies. By staying engaged with clients and having ongoing conversations, advisors can ensure that their decumulation plans continue to align with their evolving legacy goals.

Discussing clients’ desires for leaving legacies to their families or other beneficiaries allows advisors to incorporate these goals into a decumulation plan. This allows for a comprehensive and personalized approach that integrates clients’ financial security, family aspirations, and philanthropic objectives, ensuring a well-rounded strategy that reflects their values and priorities.

Other Financial Goals

In addition to retirement income and legacy goals, it’s important to discuss other financial goals and plans that clients may have for retirement. These goals may involve specific expenditures or lifestyle choices that require budgeting and financial considerations. Here are some examples:

- Travel: Many retirees have a desire to travel and explore new destinations during their retirement years. Discussing clients’ travel aspirations can help estimate the associated costs and incorporate them into the decumulation plan. This may include budgeting for flights, accommodations, transportation, and other travel-related expenses.

- Vacation homes: Some clients may have a goal of owning a vacation home or a second property where they can spend their leisure time. Owning and maintaining a vacation home comes with its own set of expenses, including mortgage payments, property taxes, insurance, maintenance, and utilities. Evaluating the feasibility and financial impact of owning a vacation home is crucial in the decumulation planning process.

- Major purchases: Clients may have plans to make significant purchases during retirement, such as buying a new car, renovating their home, or acquiring other expensive assets. These purchases need to be factored into the decumulation plan to ensure sufficient funds are available and to determine the impact on their overall financial situation.

- Lifestyle upgrades: Retirement can be a time when individuals want to enjoy certain lifestyle upgrades or hobbies they may have put on hold during their working years. This can include activities like golfing, boating, art collection, or joining clubs or organizations. Understanding these lifestyle choices and estimating the associated costs is important for comprehensive decumulation planning.

These discussions allow for a more holistic approach to retirement planning that considers not only essential expenses but also the discretionary spending that contributes to a fulfilling retirement lifestyle. Incorporating these goals into the decumulation plan ensures that clients can pursue their desired lifestyles while maintaining financial stability and meeting their overall retirement objectives.

These conversations may differ from the usual discussions advisors have focused on data, capital market assumptions, Monte Carlo scenarios, and financial planning aspects. However, they provide crucial information for effective decumulation planning and build trust with the client.

Decumulation Planning Considerations

By understanding clients’ income expectations, evaluating their assets, and discussing potential lifestyle adjustments, advisors can create a decumulation strategy that aligns with clients’ goals and maximizes their financial outcomes. These conversations provide crucial information for effective decumulation planning, including:

- What income expectations do clients have for retirement?

- Can their assets cover those expectations for as long as they may live?

- Will clients need to consider significant actions, such as a home sale or downsizing, or other lifestyle changes (e.g., less travel) or spending (e.g., fewer or smaller gifts to children) now or in the future?

A decumulation strategy emphasizes examining expectations, evaluating assets, and counseling clients when they may need to adapt their plans to produce the best results. While these conversations may be unfamiliar territory for some advisors, they play a vital role in creating a decumulation plan that aligns with clients’ goals and maximizes their financial security in retirement.

What Is Decumulation Planning?

A decumulation plan is a tangible application of the decumulation strategy that is tailored to each client’s unique circumstances. It is concrete and actionable, helping to keep clients well-informed and providing them with a road map to help clients stay on track throughout their retirement journey. A good plan is coherent, transparent, and realistic, based upon a solid strategy and bullet-proof tools. It is responsive to changes in markets or clients’ circumstances, such as health issues or death, that require revisiting and revising the decumulation plan.

A comprehensive decumulation plan for clients typically includes the following components:

-

Tax-Efficient Withdrawals

A decumulation plan provides a guide for systematically converting assets into the income needed by clients on an annual basis during retirement. This helps optimize tax efficiency and ensure that the income generated aligns with their financial goals.

-

Social Security Filing Strategy

The plan incorporates a target date for clients to file for Social Security benefits in order to maximize their overall benefits. By considering factors such as life expectancy, expected longevity, and other income sources, advisors can help clients make informed decisions about the most opportune time to begin claiming their Social Security benefits.

-

Close-the-Gap Plan

If clients need to bridge an income gap during a period when they choose to defer Social Security filing to increase their lifetime benefits, or when they do not yet qualify for pension payments, the plan outlines alternative income sources or strategies to ensure their financial needs are met.

It is important to reiterate that clients want to know the clear steps to convert assets into income and expect to understand how their investments will support their income expectations on an annual basis. They expect to have a transparent view of how their investments will support their income expectations on an annual basis. Regular check-ins with their advisor are anticipated and expected to evaluate the feasibility of their decumulation plan throughout retirement. This ongoing assessment addresses questions such as:

- Is their decumulation plan still on track?

- Do they need to adjust it for conditions like inflation or recession?

- Have there been changes to tax laws that affect their plan?

By addressing these questions and ensuring regular communication and monitoring, advisors can help clients maintain confidence in their decumulation plan and make necessary adjustments as circumstances evolve.

How Do Taxes Affect Decumulation?

Advisors can improve client outcomes by focusing on three key variables: cost, risk, and taxes. Among these, taxes have the most substantial impact on investor returns, which can be surprising but shouldn’t be overlooked. Taxes have a significant impact on decumulation and can influence the overall success of a retirement strategy. By understanding and effectively managing the tax implications, advisors can help improve client outcomes and enhance their portfolios.

One key aspect of tax management in decumulation is maximizing tax alpha. Tax alpha refers to the surplus of a portfolio’s after-tax return over its pre-tax return. It measures the additional returns that can be achieved by implementing tax-efficient investment strategies. A high tax alpha indicates the skill and proficiency of the account manager in minimizing the impact of taxes on the portfolio’s performance.

Essentially, tax alpha refers to the additional returns investors can achieve by implementing tax-efficient investment strategies. Maximizing tax alpha offers several advantages for clients and advisors:

- Client retention of gains: By implementing tax-efficient strategies, clients can retain a larger portion of their investment gains and savings. This means they have more funds available to contribute towards their financial objectives, such as retirement income or legacy planning.

- Increased assets under management: Effective tax management can help advisors and firms retain more assets under management. When taxes are minimized, clients may experience higher net returns, reducing the need for withdrawals to cover tax obligations. This, in turn, can lead to higher fees for advisors and firms.

- Wealth preservation: By considering tax implications, advisors can help clients preserve their wealth more effectively during decumulation. Strategies such as tax-efficient asset allocation, harvesting capital gains strategically, and utilizing tax-efficient withdrawal strategies can minimize tax liabilities, allowing clients to sustain their wealth over the long term.

It is crucial for advisors to proactively address tax considerations during the decumulation phase. This includes analyzing the tax implications of various investment decisions, understanding the tax-efficient ordering of asset sales or withdrawals, and exploring tax optimization opportunities such as utilizing tax-advantaged accounts. By incorporating tax management strategies into the decumulation plan, advisors can help clients maximize their after-tax income and improve their overall financial outcomes during retirement.

Tax Alpha Success Strategies

Paul R. Samuelson is SEI LifeYield’s chief investment officer and co-founder. His work is the basis for the algorithms that are the engines that power the SEI LifeYield tax-smart APIs for financial firms. Samuelson has written about and identified the five drivers of success in achieving tax alpha – tax-smart asset location, multi-account tax harvesting, tax-aware transitions, multi-account rebalancing, and optimal retirement income sourcing.

- Tax-Smart Asset Location: Investors can lower tax drag and boost wealth by locating assets in the most tax-saving account registrations (taxable, tax-deferred, or tax-free). Leveraging household portfolios amplifies the effectiveness of the technique.

By strategically locating assets in the most tax-saving account registrations, investors can minimize tax drag and boost their wealth. This involves considering whether assets are best held in taxable, tax-deferred (e.g., traditional IRA), or tax-free (e.g., Roth IRA) accounts.

SEI LifeYield’s API can assist in optimizing asset location by scoring tax efficiency alternatives and suggesting specific trades to achieve the best results. For example, holding low-return assets in traditional IRAs and high-return assets in Roth IRAs can have a beneficial effect.

- Multi-Account Tax Harvesting: Offsetting capital gains by selling investments at a loss is a tax-efficient strategy. However, it’s even more effective when considering all household accounts when pairing winners and losers. SEI LifeYield supports multi-account tax harvesting, helping clients reduce taxes, avoid wash sales, and spread gains over several years to take advantage of lower capital gains tax rates in retirement.

SEI LifeYield can operate at the tax-lot level to optimize the deductions for charitable giving. Additionally, the software can help isolate stocks in a separate account created for the spouse with a shorter life expectancy, providing a way for the surviving spouse to benefit from the basis step-up and lower capital gains.

- Tax-Aware Transitions:Tax-aware transitions include the process of transitioning a portfolio from one investment strategy to another in the most tax-efficient way.

For example, it’s surprising how unprepared some investors are as they transition from the accumulation phase to the decumulation phase in retirement planning. While investors understand that investing involves risk and market volatility, they may be less familiar with the need for portfolio rebalancing when transitioning from accumulation to decumulation to defuse highly concentrated and risky positions.

Transitioning from the accumulation phase to the decumulation phase requires portfolio rebalancing to manage risk and tax exposure.

SEI LifeYield aids in this process by providing an API for tax-efficient rebalancing across multiple accounts, in addition to on a single account. Leveraging the tax advantages of different account types during rebalancing helps defuse those highly concentrated and risky positions while minimizing taxes.

- Multi-Account Rebalancing: Most investors deal with multiple advisors, custodians, and accounts. Without multi-account rebalancing, asset allocation may be limited to individual account levels, leading to suboptimal outcomes and a mismatch between clients’ asset allocation and target risk tolerance.

SEI LifeYield, as a pioneer in household-level rebalancing, offers solutions for optimized asset allocation, asset location, tax harvesting, and tax-aware transitions.

- Optimal Retirement Income Sourcing: The transition from accumulation to decumulation is a critical phase for clients, involving significant decisions about income sourcing and sequencing in retirement. Various considerations arise, such as annuitization timing, Social Security, Roth conversions, required minimum distributions, and more. Relying solely on the “4% Rule” is inadequate for this task.

SEI LifeYield Retirement Income Sourcing assists advisors in creating personalized withdrawal plans at the household level. It considers factors such as annuitization timing, Social Security, Roth conversions, required minimum distributions (RMDs), and more. By creating a strategic roadmap for asset sales and benefit streams, it ensures clients have sufficient funds to meet their financial goals while minimizing unnecessary taxes throughout their life expectancy.

By incorporating these strategies and utilizing tools like SEI LifeYield, advisors can help clients optimize their decumulation plans, minimize tax liabilities, and enhance their overall financial outcomes in retirement.

How Does SEI LifeYield Help You Develop and Communicate a Decumulation Plan?

SEI LifeYield, through its Retirement Income Sourcing API, offers valuable support in developing and communicating a tax-efficient decumulation plan to clients. Here’s how it helps:

Quantifying Tax Efficiency

SEI LifeYield’s APIs utilize planning inputs to generate decumulation plans that prioritize tax efficiency. It quantifies the monetary value of tax efficiency by incorporating strategies such as asset location, withdrawals, required minimum distributions (RMDs), Roth conversions, product choices, and Social Security optimization. By demonstrating the potential tax savings associated with these strategies, SEI LifeYield helps advisors build a solid foundation for a secure and prosperous retirement for their clients.

“What-If” Scenarios and Multiple Options

SEI LifeYield’s Retirement Income Sourcing enables advisors to address “what-if” scenarios with clients. It provides multiple options for determining the sequence of tax-smart withdrawals over time, allowing advisors to explore different strategies and their impact on taxes. This helps clients gain a better understanding of the implications of various choices and make informed decisions about their retirement income.

Tax Breakdown and Configuration

Retirement Income Sourcing produces detailed federal and state tax breakdowns, taking into account all relevant factors. This helps clients visualize the tax implications of different strategies and provides transparency in the planning process. Additionally, Retirement Income Sourcing can be configured to align with the preferences, assumptions, and level of detail required by each firm. This flexibility ensures that the decumulation plan aligns with the specific needs and preferences of the firm and its clients.

Personalized Retirement Strategies at Scale

SEI LifeYield’s Retirement Income Sourcing API allows advisors to personalize client retirement strategies at scale without disrupting their firm’s technology investment. By leveraging the API’s capabilities, advisors can efficiently develop tailored decumulation plans for each client, taking into account their unique circumstances and goals.

SEI LifeYield’s API empowers advisors to develop tax-efficient decumulation plans, explore different scenarios, communicate the benefits of tax strategies to clients, and provide a personalized retirement strategy that aligns with each client’s needs.

What Else Can I Expect from SEI LifeYield?

Firms must weigh the benefits of adopting new technology with its costs. SEI LifeYield addresses the challenge of adopting new technology in a way that provides significant benefits to firms. Here’s how:

- Compatibility with existing technology: SEI LifeYield seamlessly integrates with your firm’s current financial planning and asset management technology. Instead of requiring a complete overhaul of your systems, SEI LifeYield APIs enhance the value of your firm’s existing software and processes. This compatibility ensures a smooth transition and minimizes disruption to your operations.

- Flexibility and control: SEI LifeYield adjusts to your firm’s preferences and evolving capabilities. The API can be configured to match your firm’s specific requirements and level of detail, allowing you to maintain control over the data and client experience. This flexibility ensures that SEI LifeYield aligns with your unique business needs and can adapt as your firm evolves.

- Proven track record: With over 14 years of experience in developing APIs that improve tax alpha and optimize Social Security benefits, SEI LifeYield has established itself as a dependable partner in the financial industry. It has earned the trust of major companies including Morgan Stanley, Allianz, Franklin Templeton, SEI, and Envestnet as well as new companies challenging large, established firms. By partnering with SEI LifeYield, firms can leverage its experience to enhance client outcomes, increase assets under management, and ultimately boost earnings.

SEI LifeYield is ready to demonstrate how its solutions can enhance your firm’s value proposition and deliver tangible benefits to your clients and shareholders. Through its proven technology, flexibility, and track record, SEI LifeYield can help your firm achieve improved client outcomes and strengthen its position in the market.

Let us show you how SEI LifeYield can enhance client outcomes, increase assets under management, and boost your earnings.

For educational purposes only. This information should not be considered investment advice.