Social Security

If you have clients who are thinking about filing for Social Security, then they likely have many questions about how it works.

If you have clients who are thinking about filing for Social Security, they likely have many questions about how it works.

Social Security is the baseline for most Americans entering retirement, but the process to file can be daunting. With so much misinformation out there, investors looking to file for Social Security will likely seek an advisor to help them through the process – which leads them to you and your firm.

Getting clients to understand their Social Security benefits and filing strategy for their unique situations can be challenging, which is why advisors should have tools and information available to help their clients through the process.

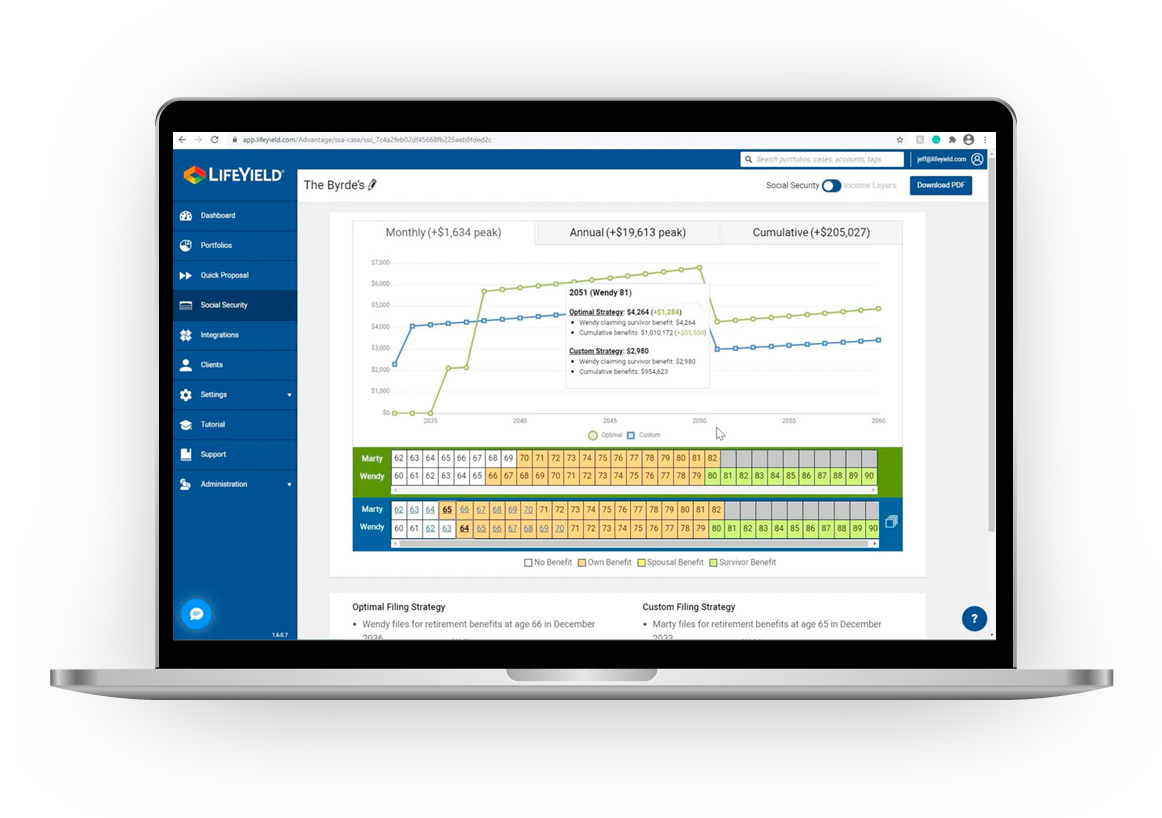

Luckily for you, SEI LifeYield has created a Social Security filing tool for you to use.

How Social Security Will Help Your Clients

Social Security benefits provide clients and their families with a stable baseline source of income when they retire. If your advisors are being bombarded with questions about Social Security benefits and are struggling to identify the best time to file for their clients to file, you should explore SEI LifeYield Social Security+™ for your firm.

The SEI LifeYield Social Security+ tool will help your advisors visually compare different filing scenarios and identify the best strategy for a client’s unique retirement needs.

When to file for Social Security is determined entirely by the client. If a client does not need retirement benefits early and decides to delay receiving benefits until after they reach Full Retirement Age, their benefit will likely increase proportionally to their delay. In some instances, their family may be able to receive monthly benefits if they meet certain requirements through the Social Security Administration (SSA), but additional research into their situation is required to know if they are eligible.

Clients should consider various factors when deciding on the optimal strategy for claiming their Social Security benefits. As they approach retirement, they can choose to either take benefits immediately or delay them. If clients don’t need the immediate assistance of Social Security retirement income, it is generally advisable to delay benefits until age 70, as this increases benefits by 8% annually.

Breaking Down Social Security for Your Clients

Your clients will typically have some basic knowledge about how Social Security works when they approach you. Clients understand they will have a reliable retirement income source, but they are looking for advice on the best Social Security filing strategy because the SSA does not offer the same level of guidance and advice that financial advisors can provide using Social Security+.

Most clients will want to maximize their retirement income, but in some situations, they may choose to receive benefits earlier.

Your client can tap into their Social Security benefits when:

- They reach the age of 62

- They, or a family member, are/become disabled

- They, a spouse, or parent dies

It is important to advise your clients that their Social Security benefits are not meant to be the only source of income when they retire. They should not plan on living off this income alone when they file. Their Social Security benefits will be able to provide them with some assistance, but it should be used in addition to other retirement income streams or earnings.

That’s where SEI LifeYield’s Income Layers add-on comes into play. Once you identify the best Social Security filing strategy for your client in SEI LifeYield, you can show them how their Social Security income will supplement their other retirement assets – using Income Layers.

Social Security Administration Experience

Once you identify the best filing strategy, your clients will be ready to file for their Social Security benefits. When your clients go to the local SSA office or file online, they should be equipped with their SEI LifeYield Social Security+ report to guide their appointment and ensure they file correctly.

To prepare your clients for their SSA visit, you should provide them with comprehensive advice on what to expect at the SSA or on their website. You should walk your clients through the best way for them to maximize their benefits at the earliest opportunity, empowering them to have a well-prepared plan when it’s time to file for Social Security.

Social Security Retirement Income

If your client is not at Full Retirement Age but wants to withdraw their benefits to help their family and spouse, using SEI LifeYield Social Security+ will help you see how much your client could optimize their Social Security benefits by filing jointly with their spouse.

Social Security benefits are a great baseline retirement income. Yet, it can be difficult for clients to gather all the information they need to make the most beneficial decision for their unique situations.

If your client decides to delay receiving retirement benefits, they will receive a benefit percentage increase for each year they delay filing. However, you will not know if waiting is right for your client until you compare all variables for their situation.

Social Security Disability Insurance (SSDI)

If your client has a physical or mental disability that is medically diagnosed to last a year or until death, then they might be able to start receiving Social Security disability benefits before Full Retirement Age. It is important to note that just because your client qualifies as disabled through a different agency they are not automatically eligible to receive Social Security benefits from the SSA.

In order for your client to determine if they will be able to receive benefits from the SSA before Full Retirement Age, they should read through the Disability Benefits manual.

Clients who have worked long enough and paid Social Security taxes may be eligible for SSDI (Social Security Disability Insurance) benefits if they are disabled and have dependent children in need of financial assistance.

Benefits for Spouse and Family

When your client decides to file for their Social Security benefits, they may also be able to receive benefits for their spouse or family.

Depending on the age of your clients and the ages of their spouses or family, individuals could receive benefits from the SSA if…

- They are disabled

- They pass away

In the unfortunate event of a client’s passing, their surviving spouse and dependent children may be eligible for Survivor benefits. These benefits can provide a source of income to help support the surviving family members. The Survivor benefit amount received is typically based on the client’s earnings record and the age of the surviving spouse or children.

Clients should understand that the rules and regulations surrounding spousal and family benefits can be complex. They should consult with an advisor or utilize the resources provided by the Social Security Administration to fully understand their options and make informed decisions.

By considering the potential benefits available to spouses and family members, clients can better plan for their own retirement and ensure that their loved ones are provided for in the future.

How the Application Process Works

After clients meet with your advisors to create the optimal Social Security plan, they will set up an appointment at an SSA office to file.

Clients also have the flexibility to begin the filing process through alternative methods. They can choose to call the SSA by phone to start their application or utilize the online filing option, which provides a convenient and accessible way to apply for benefits.

When your client has their appointment, they may need to provide certain documents to receive benefits. These documents could include:

- Birth certificate or document to prove birth

- Proof of U.S. citizenship or lawful alien status

- Military service papers

- Copy of W-2 forms or self-employment tax documents

- SEI LifeYield Social Security+ report

It’s important for clients to carefully gather and provide all the necessary documents requested by the SSA to avoid delays or complications in the benefits application process. Being well-prepared and organized with the required documentation can help ensure a smooth filing experience and quick processing of their Social Security benefits.

Once a client’s SSA application has been approved, it can take a month or two before they receive their first Social Security check. Clients should know it’s not instantaneous and have a plan in place.

If your client is drawing from Social Security for disability benefits, their first check will be sent six months after their disability began. It is important for them to apply for disability benefits as soon as possible since it can take between three and five months for their application to be approved.

If your client has further questions about the application process or how the Social Security system works, they can consult the Social Security Administration’s official website for more information.

Enable your firm with Social Security and Retirement Income technology

How SEI LifeYield Social Security+ Can Help

If your firm is looking to give your clients the best Social Security advice, look no further than SEI LifeYield.

SEI LifeYield Social Security+ is available via API or a simple UI. It was made to help the financial advisor community easily answer the most complex questions about Social Security.

- When and how should I file?

- How does the SSA work?

- What’s the best strategy for me and my family?

- How much money do I need for retirement?

- How do we fill the income gaps we identified?

- How does Social Security work with my other assets to get me through retirement?

SEI LifeYield Social Security+ helps advisors answer all these questions and more by:

- Comparing different strategies to help clients file

- Looking at the full retirement income picture

- Identifying income gaps and helping advisors position products to fill them

- Giving clients peace of mind as they file

You can watch a demo here to see how SEI LifeYield Social Security+ works in under 3 minutes. To use the tool, jump right to the pricing page and sign up. Your clients do not have to suffer through filing for Social Security any longer.

For educational purposes only. This information should not be considered investment advice.