Asset Location

What if there was a way for your firm to show a client exactly how you’ll increase their assets after taxes throughout their financial life?

This type of blueprint is not the standard for financial advisors to deliver to clients. But it should be.

In the past, clients had to assume that advisors were doing everything they could to maximize their returns. They know that what you have to offer is valuable, but they don’t know exactly how valuable it is. And until now, advisors couldn’t put a number – or a dollar value – on the actions they were performing for clients.

It isn’t nonsense, though. SEI LifeYield can measure the tax efficiency of an entire household portfolio and assign it an asset location score between 1-100. The next output is a list of the next-best actions for the advisor to take to improve the score. SEI LifeYield then goes one step further, quantifying each action – and the whole project – with a dollar amount.

For example: Before optimization, your client’s portfolio might return a score of 45. After optimization and using the plan put in place by SEI LifeYield, the asset location score boosts to 70. These numbers may not mean anything to your client by themselves, but if you can tell them that that optimization of the location of assets means an additional $250,000 after taxes in the future – they will definitely appreciate that.

Understanding Asset Location

There are different types of accounts where people can save and invest money. These are distributed into qualified and non-qualified accounts. Asset location is a tax-minimizing strategy that requires allocating different investments into accounts with different tax treatments – tax-exempt, tax-deferred, and taxable.

The asset location process is different than asset allocation. Asset allocation is an investment strategy that attempts to balance risk versus reward by adjusting each asset’s percentage within the portfolio (or each account) based on the risk tolerance, goal, and investment period.

When you combine the two strategies, the focus is on keeping the overall household portfolio in line with this target asset allocation.

What’s the Point of Asset Location?

Asset location helps with:

- Managing the bigger picture – Before you can organize your client’s assets across accounts, you need to determine the household allocation based on the unique investment goals and risk tolerances. That is why allocation comes before location.

- Planning the goals and timeframe – Is the point of this to create a retirement plan? How long exactly do clients have before the funds are ultimately withdrawn? While asset location is important, it tends to play second fiddle to other needs. But it shouldn’t.

- Managing tax-advantaged accounts – Figure out which account opportunities your clients have. With the tax codes evolving, it becomes imperative to get in the habit of checking these facts regularly… or you could let SEI LifeYield do it for you.

Asset location isn’t just about sheltering assets and accounts from taxes. There have to be trade-offs that ensure the most is being made of the tax-advantaged space. Clients may also need access to these assets at certain times, meaning your firm will have to know which account is most tax-advantageous to withdraw from. That may become complicated depending on where the funds are located.

Three Main Types of Investment Accounts

As a firm, your advisors are tasked with helping clients determine where they need to invest and what types of accounts they should invest assets in. Not every trade causes a taxable event. But if your client is buying and selling often in a regular brokerage account, they may be unaware that they’re incurring a large tax bill. It’s up to the advisor to educate their clients on the nuances of tax-efficient investing.

Since some accounts will have better tax advantages over others, helping clients look at the complete household of accounts and how to locate the funds within them for more tax efficiency is made easier by the SEI LifeYield Taxficient Score® and asset location technology.

Taxable Accounts (Stocks, Bonds, ETFs, etc.)

Taxable accounts, like traditional brokerage accounts, hold securities like stocks, bonds, ETFs, mutual funds, etc. These are taxed when dividends or interest are earned or realize any capital gains by selling investments that have gone up in value.

Tax-Deferred Accounts (401(k), IRAs, etc.)

Tax-deferred accounts include 401(k)s, IRAs, etc. These allow the payment of taxes to be delayed until the money is withdrawn. At that time, it is taxed as ordinary income.

Tax-Exempt Accounts (Roth IRAs, HSAs, etc.)

Tax-exempt accounts like Roth IRAs, HSAs, etc., require income taxes to be paid upfront. Still, they allow the investor to avoid further taxation as long as all rules are followed. Fully tax-exempt accounts like HSAs allow for pretax or deductible contributions, earnings, or withdraws, as long as it is used for qualified medical expenses.

Understanding Asset Allocation

Asset allocation, as previously defined, is the strategy of balancing risk and reward by managing a portfolio’s assets in line with individual goals, risk tolerance, and investment horizon. There are three asset classes in asset allocation – equities, fixed-income, and cash and equivalents. Each behaves differently over time.

Asset allocation is the first step in the process. But there is no simple formula for finding a simple asset allocation for every individual. It is an important part of the investment process, though, and needs to be addressed upfront. It helps to establish this so that the subsequent asset location strategy can have the right guardrails for each client. Where each funded investment is ultimately located can determine the results of the overall investment portfolio.

Any strategies that are used for a portfolio should be done with risk tolerance and the investment length in mind.

There are different approaches to creating the ideal asset allocation for each client:

- Strategic asset allocation: a proportional combo of assets based on the expected rates of return for each class. “Buy and Hold” strategy.

- Constant-weighting asset allocation: the constant rebalancing of the portfolio. There are no hard-and-fast rules for portfolio rebalancing.

- Tactical asset allocation: to use tactical asset allocation wisely, you have to identify the short-term opportunities and make small, temporary moves for those in a portfolio.

- Dynamic asset allocation: the constant adjustment of the asset mix as the market rises and falls.

- Insured asset allocation: you set an amount in which the portfolio should not be allowed to drop under.

- Integrated asset allocation: integrated allocation combines aspects from the other allocation strategies and accounts for the expectations, capital market changes, and risk tolerance.

Asset allocation is a critical foundation for every investment portfolio, but it’s just the beginning.

Can Your Firm Benefit from SEI LifeYield Asset Location?

There are four main criteria you need to look at to see if optimizing the location of a client’s assets will be beneficial (hint: there are very few instances where it isn’t beneficial). The more criteria your client falls into, the more likely they will benefit, providing a greater after-tax return.

Your client is currently paying a high marginal income tax rate.

The higher the marginal income tax your client pays, the bigger the potential benefits of using asset location strategies. As a rule of thumb, the more money earned, the higher the marginal tax bracket your client will end up in. As a consequence, additional income is significantly reduced due to the higher tax rate.

You expect that your client will pay a lower marginal tax rate in the future.

If you expect that your client’s marginal income tax rate will be lower in the future, using an active asset location may make it possible for them to defer or reduce their taxes now. One situation where this occurs is when investors retire. They typically see a drop in the marginal income tax rate.

Your client has significant assets in tax-inefficient investments that are held in taxable accounts.

For tax-inefficient investments, like bonds or bond funds, there is greater potential to increase your client’s after-tax returns using the asset location score. You can do this by executing a plan based on asset location technology from your firm. Luckily, SEI LifeYield can help.

Your client expects the investment to last more than ten years.

Asset location strategies are not an instant reward system. For a proper implementation and positive outcome, it can take ten or more years invested for clients to see the return they hope for. The longer their assets are invested, the greater the potential for seeing the impact of an asset location strategy.

Where Do Your Capital Investments Rank?

When a client can benefit from the asset location strategy, advisors have to choose which of the assets they assign to tax-advantaged accounts and which to leave as taxable. This has long been a tedious, drawn-out, manual process. SEI LifeYield can scan, measure and recommend portfolio tax efficiency improvements in seconds, helping to minimize human error and provide the highest after-tax return for the client.

Higher Tax-Advantaged

In general, the higher tax-advantaged assets are:

- Individual Stocks – As a general rule, these are reasonably tax-advantaged when bought and held for at least one year

- Equity Index Mutual Funds – ETFs included, these are also reasonably tax-advantaged

- Tax-Managed Equity Funds – These are the equity funds that explicitly name tax-advantage as the goal

Lower Tax-Advantaged

In general, the lower tax-advantaged assets are:

- Bonds and Bond Funds – These are highly tax-disadvantaged due to the interest payments generated and their taxation at a higher ordinary income tax rate. The potentially higher returning types of bonds and investments are the ones that become the most tax-disadvantaged. This does not include tax-free municipal bonds, funds, and US Savings Bonds.

- Actively Managed Stock Funds – Higher turnover rates are less tax-advantaged because they have higher capital gain distributions rates. If they happen to distribute short capital gains, they are taxed at higher ordinary income tax rates.

The Old Way of Looking at Asset Location

The table below is a high-level representation of how our industry used to approach asset location. But hard rules like this don’t always account for the unique variables that come with each household portfolio.

More Appropriate

Appropriate

Less Appropriate

How You Treat Taxes on Expected Returns |

Taxable |

Tax-Deferred |

Tax-Exempt |

|

| Tax-free municipal securities and municipal mutual funds | Exempt | |||

| Equity securities held long-term for growth purposes | Taxed at long-term capital rates | |||

| Equity index funds/ETFs (except for REITs) | ||||

| Tax-managed mutual funds and other managed accounts | ||||

| Real Estate Investment Trusts (REITs) | Typical: 80% of income is taxed at ordinary rates; 20% tax-exempt | |||

| High-turnover stock mutual funds – Deliver short-term capital gains | Taxed at ordinary income rate | |||

| Fully-taxable bonds and corporate bond funds | ||||

SEI LifeYield Asset Location enables advisors to take the most appropriate approach to asset location for each client. SEI LifeYield uses its Asset Location Score to benchmark and rank each asset location recommendation by its increase to the score. On top of that, each recommendation also comes with its impact on after-tax returns in dollars.

Until now, it’s been almost impossible to have a discussion about asset location with clients, even if you’ve been doing it for years. The SEI LifeYield Asset Location Score makes those conversations much easier to have.

Why is Asset Location Rarely Talked About?

Asset location is not a practice that is considered flattering by any means. If you ask financial planners and other fund managers, it is a rather boring topic. It is something that only someone with a specific skill set gets excited about. But its impact on a household portfolio is undeniable.

Many of the people who ask about it prefer to take a holistic approach to their investments. Clients don’t get rich overnight using asset location with their investments. If investors who choose to use asset location do not use a systemic approach and have advisors to watch their assets, they may end up with:

- Missing Pieces – The best approach for asset location involves looking at the entire picture for your client’s financial accounts. Depending on how long they have been acquiring these financial assets, they can end up spreading out. It can be hard to get a complete picture without taking the holistic approach and envisioning how investments fit together in the overall retirement plan.

- Missing Expertise – Even with the most up-to-date picture of accounts and holdings, asset location is not a simple solution. Finding your ideal answer will depend on what complex wealth management needs exist, the technology available to that advisor, and how advantageous it is to optimize the accounts.

- Missing Oversight – Asset location is not a one-and-done solution to any financial asset. The constant evolution of the market and regulations require ongoing coordination and review to keep things moving smoothly.

In reality, asset location has the potential to increase the amount of money working in each portfolio. Still, many don’t know what should be done or don’t have the tools to handle the process. SEI LifeYield enables this for firms and their advisors, giving them the tools and the optimization needed to make the most out of an asset location strategy – one that benefits clients from a tax-efficiency perspective.

How Tax Efficiency Brings Competitive Advantage

Using software for your firm’s asset location solution can help you gain the competitive advantage needed for leveraging tax efficiency with clients. However, asset location has been a black box for advisors to explain to clients. “Trust me, it works” has been the standard. SEI LifeYield makes it possible to become more tax-efficient with your asset location while quantifying the benefit of the strategy to the client in dollars and cents. This quantification of benefit is a massive opportunity for advisors to simplify the tax-efficiency conversation.

SEI LifeYield Asset Location technology can:

- Instantly improve your client’s tax efficiency using our proprietary asset location algorithm that scans all of your client’s accounts in the portfolio and pinpoints the tax-smart location for every asset in seconds.

- Measure the tax efficiency of each client’s portfolio on a scale of 0-100 and produce the blueprint they need to improve their score.

- Quantify the benefits in dollars by assessing a dollar value on asset location optimization across different time horizons.

- Avoid replacing old technology. The SEI LifeYield solution integrates with current resources already in place, avoiding tech disruption.

Key Benefits When Using Asset Location Solutions

When you bring SEI LifeYield Asset Location in to help coordinate all accounts within a household and offer the optimizations for asset location at scale, you can trust that the solution has been battle-tested by the largest financial institutions in the world.

The key benefits of using the API are:

- It functions as an overlay, coordinating accounts that run on different systems and in different ways. This eliminates the need to replace the current technology onsite.

- Avoid unnecessary taxes for clients to keep more assets invested, allowing you to build trust and increase clients’ after-tax returns over time.

- Boiling the tax conversation down to a single number.

- Quantifying the dollar benefit from tax optimization to the advisor, firm, and client.

- Increasing your advisor AUM by helping clients keep more of their earnings through the asset location process.

What is the Process of Creating a Tax-Smart Household?

Part of the asset location strategy relies on the overall structure of the client’s total household portfolio. A household portfolio is comprised of the assets your client has across various accounts – not just with your particular firm. Householding allows advisors to look across all accounts and assets to see where the client can benefit from increased tax efficiency.

Here is what your firm will have to do to make smart-householding a solution that creates increased tax efficiency from asset location:

- Create an aggregated view of the client’s account. This view is the cornerstone of providing comprehensive guidance to the individual investor. Simply looking at the data isn’t enough. Smart-householding is all about seeing all holdings, implementing a tax-smart strategy, and quantifying the benefits in dollars.

- Perform a risk and tax efficiency audit of the client’s household and accounts. An audit always starts with analyzing your client’s risk tolerance and the misalignment seen in recent market trends. This assessment helps to clarify the client’s objectives and can set the foundation for where each asset should be located. Taxes are, and will always be, one of the single largest costs to an investor, which is why locating assets in the most tax-advantaged accounts is imperative to overall results.

- Implement a tax-smart asset location plan that is consistent with the risk tolerance of your client. Tax-smart location is achieved by ensuring that your client’s tax-efficient assets are placed in taxable accounts. The tax-inefficient assets should be located in tax-qualified accounts. There are some exceptions to this, but it’s a general starting point for those on the front 9 of their asset location journey. Tax-smart asset location helps clients keep more by improving the after-tax outcome for both investors and your firm.

- Explain your methods and the improved outcome projection. The best way for your client to understand what is going on with their investments is for your advisors to show them. SEI LifeYield’s asset location score does that. Your client can see a pre-optimized score and a post-optimized score. Your advisors can also benchmark each household with the score and an overall dollar benefit amount.

- Don’t limit the advice you have to just your firm. Ask your clients if they know others who would benefit from learning the score of their current household or single portfolio. After showing clients what you can do for them, they will want to spread the word about your firm and how your advisors are working to build up each client’s future.

Asset Location Helps Build a Diversified Portfolio

Even in a booming market, firms will advise their clients not to put all their eggs in one basket. Because the market is very fickle and can change at any moment, having every asset allocated to one specific investment can be risky. Part of an asset location strategy is having a diversified asset allocation to help weigh the risk with the gains.

What Is Diversification?

Diversification is a management strategy commonly used by individual investors, financial planners, and fund managers to offset risk by owning different types of investments (rather than just US domestic stocks, for example). With a variety of investments, the hope is that the risk of investing is decreased.

This concept is not new, nor is the idea of investing. Investing is an art form, and talent comes with discipline. By the time the average reaction occurs in a market change, most of the damage has already been done. Having a well-planned investment strategy that incorporates all of the various aspects, including diversification, allocation, and asset location, are a few ways to ensure portfolio stability.

Here are some considerations when putting this all together:

- Spread Your Wealth: Without the right guidance, clients can quickly allocate into one investment type. For many, the allure of equities and investing everything in one stock or sector can seem like the right choice. Still, the real opportunities lie in ETFs and investing in more than one company you may already deal with regularly. Commodities should also not be ignored, especially globally. Don’t go too far, though. Make sure you’re educated before making any drastic investment decision.

- Consider What Index or Bond Funds Can Do: Adding index funds and fixed-income to the mix can make long-term diversification a reality. These types of funds often come with lower fees, which puts more money in your client’s pocket. There is little to do when managing these funds, making them easier to digest than other types of investments.

- Continue to Build the Portfolio: Add (if necessary), audit, and rebalance accounts in your client’s portfolio regularly.

- Know When to Get Out: Even with the soundest strategy, your advisors still need to keep a regular pulse on client investments. Keeping a watchful eye on the market and each household-level portfolio can let advisors know when it is time to cut losses or when they should connect with their client about a new strategy or idea.

Investing should be an enjoyable experience – not one that causes extreme stress and turmoil. SEI LifeYield wants to simplify the process for firms and their advisors while making clients more money over the long term with a tax-efficient strategy.

The SEI LifeYield Technology Library

SEI LifeYield doesn’t only provide asset location solutions for firms and advisors. We also provide an entire technology library that can help with portfolio and other financial management needs. In addition to the SEI LifeYield Asset Location solution discussed above, the library also includes:

- SEI LifeYield Multi-Account Rebalancing – This API operates alongside any current rebalancing technology currently in use by your firm. It incorporates multi-account tax harvesting and automated asset location optimization.

- SEI LifeYield Tax-Smart Withdrawals – This API executes withdrawals from multiple accounts by selling mislocated assets, minimizing drift, and identifying tax-loss harvesting opportunities.

- SEI LifeYield Tax Harvesting – This API works with the SEI LifeYield asset location, rebalancing, and withdrawal technology to scan all non-taxable and taxable accounts and instantly identify opportunities to harvest losses and/or gains.

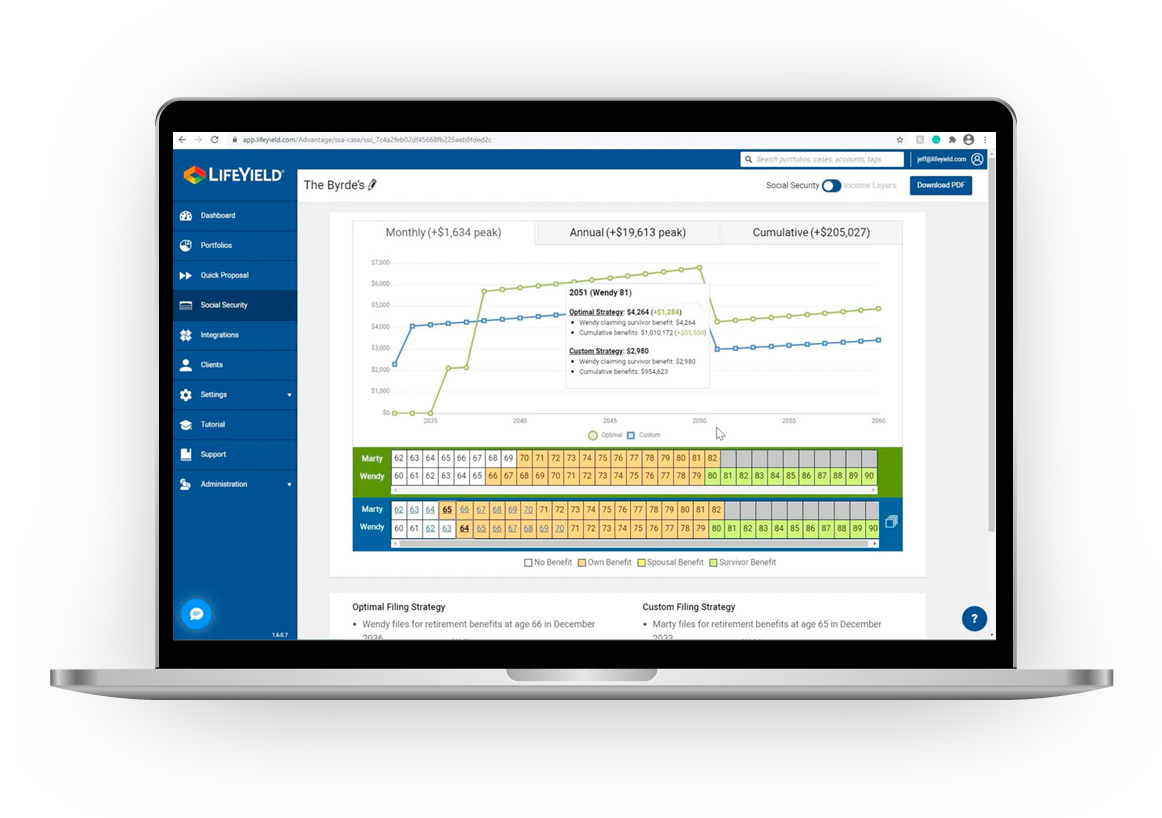

- SEI LifeYield Social Security+ – The only SEI LifeYield solution available via UI or API, Social Security+ provides tools to identify the optimal Social Security filing strategy for every client and subsequently transition to a full retirement income discussion with the visual Income Layers add-on.

SEI LifeYield’s products are designed to work together to create more consistency across the Unified Managed Household of each client while ensuring optimal tax efficiency. How long would it take for your advisors to consider all the areas where assets could be located and their potential tax advantage without an automated process?

Why Companies Need Asset Location

Asset allocation is an important part of planning for retirement. Again, taxes represent the single biggest drag on investment returns, so asset location makes a difference. When a client looks at a retirement account and sees that there is $750,000 in it, they feel as though they are well on their way to a happy retirement. The reality is that this amount doesn’t reflect the taxes that will be owed to the government for those tax-deferred funds. How surprised will they be when they discover that the accounts were not allocated for optimal tax efficiency, and post-tax, they will only receive $500,000? A maximized runway is potentially the most important thing a client needs in retirement.

Since 2008, SEI LifeYield has been doing just that. We enable financial services firms to improve overall tax efficiency for clients, make tax-smart withdrawals from multiple accounts, and set clients up for a maximized retirement income strategy.

As an industry, we are on the cusp of finally creating a true Unified Managed Household. Asset location is crucial to this becoming a reality. Many firms have already started their asset location and UMH journey. Are you in?

For educational purposes only. This information should not be considered investment advice.