LifeYield Upgrades Seeks to Help Advisors Bring in Held-Away Assets

Founded by a 2017 WealthManagement.com “Ten to Watch” alumni, Mark Hoffman’s LifeYield is unveiling several new advisor-friendly features meant to help boost conversations with clients around held-away accounts.

Helping clients realize “tax alpha” is a hidden-in-plain-sight differentiator for many advisors seeking to separate themselves from the pack. There’s not much an advisor can do about the markets, but tax-aware asset allocation can add up to 75 bps of additional portfolio return, according to a Vanguard report. Envestnet pegged the value of maximizing the tax efficiency of a client’s overall portfolio even higher, noting that an advisor making the right calls can add an annual value of up to 100 basis points return for the client.

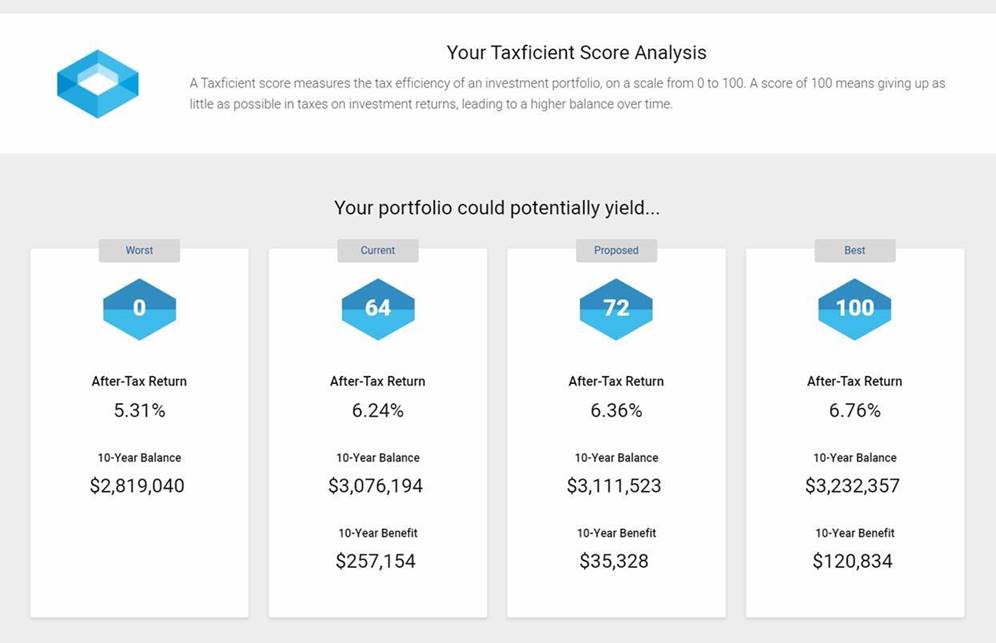

LifeYield now shows current, proposed, and optimal tax efficiencies in dollars and cents.

LifeYield now shows current, proposed, and optimal tax efficiencies in dollars and cents.

To help advisors provide that service, tax analysis and optimization provider LifeYield announced a handful of new features to its platform. The company’s bread and butter, an indicator of a household portfolio’s tax efficiency called a Taxficient ScoreTM, remains the premier feature. But the new tool is designed to be more surgical and nuanced in the information it conveys.

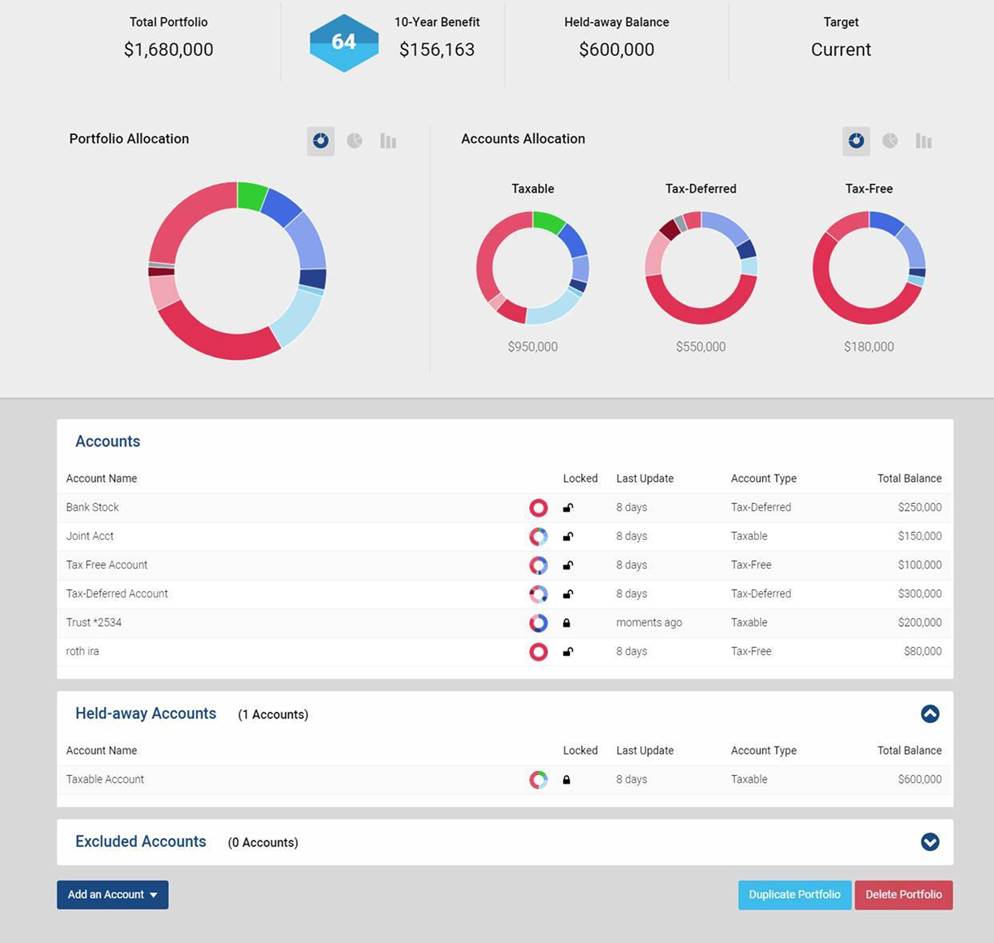

Among the improvements, which are scheduled to be showcased in the coming week, are features allowing advisors to provide proposed-portfolio feedback, categorize assets according to the advisors’ own criteria, and distinguish between held-away, locked and excluded accounts.

Instead of just giving an after-tax return for a client’s current portfolio and a theoretical best-case scenario for minimizing the taxes on the portfolio, the tool now allows advisors to input a proposed portfolio and LifeYield will display the after-tax return for it, giving the advisor more flexibility in suggesting allocation changes and more transparency into the tax implications of those changes.

Another new feature is the Taxonomy tool, or “product-agnostic smart mapping,” which allows advisors to group assets by categories of their own choosing; For instance, advisors dealing with subjective labels like environmental, social and governance (ESG) products or socially responsible investing (SRI) demands can now apply their own labels to the investments. “When advisors present the concept of tax planning or being tax efficient, it often becomes a discussion about investment selection or portfolio management,” said Steve Zuschin, EVP of Sales at LifeYield. The new ability to categorize investments according to the advisors’ criteria can let “the tax planning conversation stand on its own legs.”

The other big change is that an individual advisor can show clients the tax efficiency of just the portfolios he or she is managing.

Advisors can lock and unlock accounts, as well as distinguish between held-away and excluded accounts.

Advisors can lock and unlock accounts, as well as distinguish between held-away and excluded accounts.

Advisors can use the tool to mark non-managed accounts as held-away, or in legacy holdings or accounts at a bank or 529 plan; in some cases, seeing the tax inefficiency of some of those assets is an opportunity for advisors to bring some of those assets under their management. “It now allows you to have that conversation of, ‘Here’s where you currently are, here’s what we’re proposing and here’s the optimal,’” said Zuschin. “You can actually highlight some cases of how having those assets held away could actually hurt the client, or [show] how much is it costing them to work with multiple advisors.”

The average annual after-tax return benefit for accounts using LifeYield is 69 bps, said co-founder Mark Hoffman.

Read the full feature here.