LifeYield Featured on Financial Planning

What if checking a portfolio’s tax efficiency was as simple as checking a FICO score?

What if evaluating the tax efficiency of any given investment portfolio was as simple as checking a FICO score?

LifeYield, a provider of cloud-based tax and financial planning services, is trying to do just that with its Taxficient Score. The company is making the proprietary score, which was previously available only to large financial services firms like Morgan Stanley and Franklin Templeton, available to independent financial advisors, accountants and tax practitioners.

Advisor-technology veteran Steven Zuschin has joined the company to build its direct-to-advisor channel. He likens the Taxficient Score to credit scores.

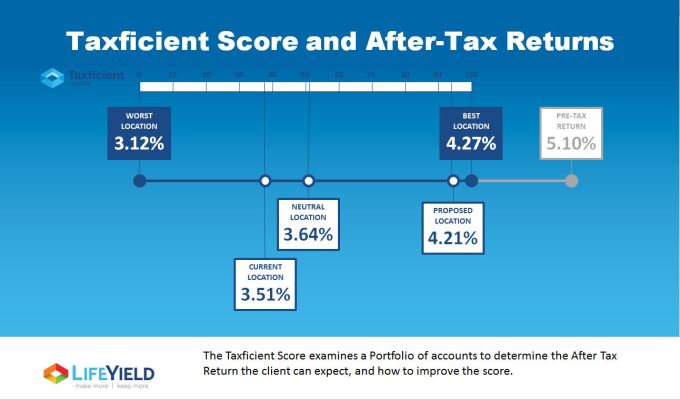

“You can take any portfolio of accounts, ranging across the spectrum of different types of products and investment strategies, to get an overall score of zero to 100 of how efficiently those assets are managed as it relates to taxes,” he says. “The higher the score, the more money clients get to keep when they go to liquidate those investments and turn them back into spending money.”

He believes the technology can also help accountants and financial planners provide tax-planning advice to clients. If they “run a review and uncover that a client has a low Taxficient Score, maybe under 50, that’s a call to action not only to review the investments, but also to start coordinating the team around that client so everybody is working together to ensure that client gets the best possible outcome,” he says.

To use the technology, a tax professional can look at the client’s effective tax rate for income along with the long-term capital gains.

“While we’re going to focus on the asset allocation, we want to make sure the investments that they have are taking advantage of the tax code,” Zuschin says. “You might have brokerage accounts or taxable accounts, or tax-deferred or qualified accounts, and then maybe even some Roths. We want to make sure that we’re taking full advantage of the benefits of either a tax-free, tax-deferred or taxable account, and have the correct investment in those accounts. We do all that while maintaining or hitting the target risk allocations for the client’s household.”

The tool can also help advisors navigate complications that come along with handling multiple financial accounts, he says. He gives the example of a client who might have a 50-50 stocks-to-bonds asset allocation.

“They apply a 50-50 asset allocation across all of their accounts, but they’re not particularly coordinating or taking advantage of the benefits of some of the tax deferral or tax-free accounts that they have,” he says. “It might be more advantageous to have their equities and their high-returning products in a tax-deferred account, and then use something like muni bonds in their taxable account. That’s a real simple example, but one account will look really conservative and another really aggressive, but it can net out at a 50-50 allocation for the household.”

Advisors can access a trial of the Taxficient Score and calculator. “We’re available to thousands of advisors through different strategic partnerships, through different broker-dealers and networks, but anybody can come to LifeYield and access the free version of our software by subscribing without having to pay,” he said. “Individual professionals can come in, whether they’re accountants or financial professionals. They can license the software and use it directly with their clients, and not have to wait on a large firm to roll out an enterprise version of it.”

Pricing is typically $1,000 per year, or $100 per month.

An elective feature lets professionals turn on a Social Security maximization tool to provide a timely discussion around tax season for clients.

Read the full feature here.