Clients Need Help Finding the Right Time to File for Social Security Benefits

To delay or not to delay? That is the question that your clients might be asking when they come to you for advice about their Social Security benefits. Retirees across the country are losing trillions of dollars in Social Security benefits because they file too early. These are the ones who didn’t seek out the help of a professional specifically dedicated to understanding the Social Security system.

On top of this, they lack the retirement accounts (outside of Social Security) to supplement the income they receive from the Social Security Administration (SSA) each month. Many of your firm’s incoming clients with accounts that could be used to supplement Social Security have been neglecting them for so long there may be very little your firm can do to make them tax advantageous. Talk about being between a rock and a hard place.

How to Prepare Clients For Social Security Claiming

Information and preparation are key when getting ready for retirement. Claiming Social Security is synonymous with retirement. So, when looking at the equation of investments plus Social Security benefits, you are the one providing your client with the answer on how comfortably they will be able to live during retirement. This is a difficult conversation to have, and your firm needs to be prepared.

Which Type of Firm Are You?

There are two primary types of retirement conversations firms have with clients. One focuses more on the Social Security benefits side of the equation. In contrast, the other focuses on investment accounts and how they are managed for maximizing retirement income. Both often ignore one another in the process. It’s time for that to change.

Which conversation does your firm have when it comes to retirement for your clients?

If this isn’t your first time dabbling in LifeYield’s product offerings, you know that this is a trick question. To properly serve clients, you have to be well-rounded on both fronts – looking across the entire unified managed household.

Unified Managed Household and Social Security Benefits

LifeYield’s proprietary technology helps coordinate all parts of your client’s portfolio (investment, long-term retirement accounts, and Social Security benefits) to improve investment outcomes for clients.

What makes a unified managed household? Throughout a client’s working life, a person may work for several employers. Each of these employers may offer a 401(k) retirement plan that the employee contributes to on top of the employer’s contribution. Not every company does a good job of explaining the terms of a 401(k) or how to roll it over so that you don’t end up with numerous distributed accounts.

LifeYield uses the principle of the unified managed household, or UMH, and allows you and your advisors to look at every account holistically. A plan can then be created to maximize the tax efficiency of the accounts while minimizing the tax consequences overall for the portfolio.

The UMH doesn’t only include tax. Social Security is also a major part of the equation. If you’re looking to maximize retirement income, you need a plan that incorporates all streams of income and shows how they’ll work together to help each client thrive in retirement.

The Social Security Administration – Your Benefits

If you have ever visited the SSA’s website, you know that there are tools and calculators that allow you to estimate your potential earnings for retirement. With every factor considered in the benefits process, no two clients’ social security benefits will be the same. Plus, all the information available about Social Security benefits on the website (which your client will have most likely already Googled) is generic and not necessarily specific to their unique situation.

Social Security employees cannot tell anyone applying for benefits what they should do, only what they can and can’t do. They discuss facts – if you retire at this age, the calculation is this amount, and so on. They are not financial experts, nor are they trained to give this type of advice. If your clients have not visited the SSA yet to discuss their benefits and filing for them, we urge you to advise them to do their own research and make their own decision.

Is Your Client Trying to Decide When to Take Social Security Benefits?

With each financial relationship with the SSA being different, retirement can play out differently for every individual. The first real determining factor for figuring out retirement benefits is your clients’ full retirement age.

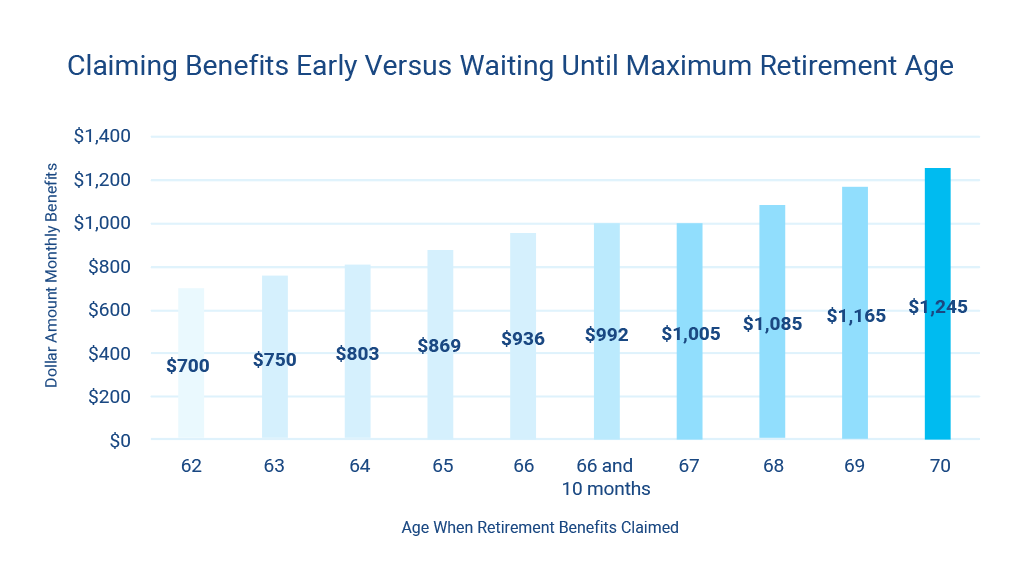

Full retirement age is the age at which Social Security says your client can retire with full benefits based on their birthday. The range for full benefits falls somewhere along 66 to 67 but may be taken as early as 62 (with a reduction) or as late as 70 (with an increase).

What Happens if Benefits are Claimed too Early?

The closer to age 62 that someone claims their Social Security benefits, the less they receive based on their predetermined full retirement age. The percentage of what a client gets from their maximum benefit amount will be reduced by 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each month after. The reduction overall can result in a loss of 20 to 30% of Social Security income.

What Happens if Benefits are Claimed at Age 70?

Clients who choose to wait and receive the maximum benefits plus the delayed retirement credits offered to them from SSA can add approximately 2/3 of 1% per month to their benefit. The percentage is based on the birthdate of your client but could result in significant retirement income increases.

| What happens when your client waits to file for social security benefits until age 70? | |

|---|---|

| Birth Year | Maximum percentage applied to full benefit amount |

| 1941 | 132.5% |

| 1942 | 131.3% |

| 1943 – 1954 | 132% |

| 1955 | 130.7% |

| 1956 | 129.3% |

| 1957 | 128% |

| 1958 | 126.7% |

| 1959 | 125.3% |

| 1960 | 124% |

Looking at the Entire Picture – Claiming Early Versus Waiting Until 70

The chart above explores what a client might be looking at in terms of benefits based on age if their maximum benefit amount is $992 with a full retirement age of 66 and 10 months. Claiming early (at 62) results in reducing the client’s monthly payment amount by approximately $292 if they don’t wait until full retirement age. Adversely, if they wait until 70, which is only three years and two months from their full retirement age, they can increase their monthly benefits by approximately $253 more per month.

Don’t Forget About Medicare

Three months before turning 65, your client will have to sign up for Medicare. The requirement to do this even includes those who are still working at this age. While waiting to sign up is possible, there are fees associated with signing up late.

We aren’t going to go into the long and complicated process that is the Medicare system (Social Security benefits can be hard enough to swallow), but we do bring it up because recipients are required to pay premiums monthly, which further reduces the amount of the overall benefit received. This is something to keep in the back of your mind while preparing your client’s benefit estimates.

LifeYield Social Security+ with Income Layers

LifeYield Social Security+ with Income Layers is a game-changer for clients considering filing for their Social Security benefits. With a few simple inputs and the click of a button, your firm can determine the best filing strategy and visualize its impact on the complete retirement scenario across a client’s entire portfolio.

What LifeYield Social Security+ Does for Firms

- Compare Social Security benefit filing strategies. Looking across all client accounts, can the client afford to wait until 70 to file? If they have been diligent about investing and preparing for retirement all these years, what’s the best course of action? These questions are what LifeYield looks at when comparing different filing strategies. When running the numbers, LifeYield can instantly determine if they get the best benefits by retiring at age 62 or waiting until 70. It may benefit them to wait.

- Visualize all retirement income layers for each client. Income Layers shows you how to coordinate the best Social Security filing strategy with the other streams of income from your client’s financial portfolio. This allows advisors to have a visual guide during their retirement income discussions with clients, opening the door to effective communication.

- Fill in any income gaps that may pop up. Clients often discover gaps in income when planning for retirement. LifeYield can uncover these easily and opens the door for conversations about Life Insurance or annuities to supplement the current income.

- Print out the roadmap to success. One of the greatest assets your client can have when filing for Social Security benefits is the roadmap of exactly how retirement will look. Granted, nothing is 100% set in stone, but they will have a general idea of what needs to be accomplished to live within their means. The visual nature of the LifeYield tool helps advisors and clients stay on the same page throughout the process.

Using LifeYield’s Social Security+ with Income Layers in Real Life

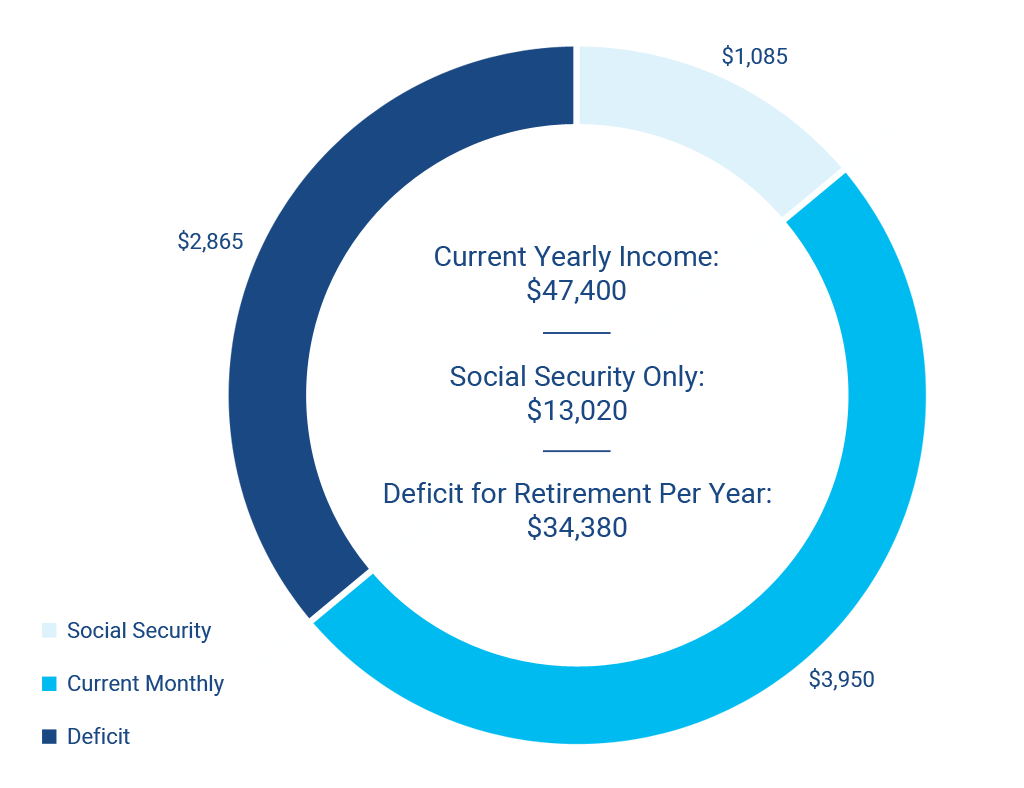

Let’s pretend that a client comes into your firm seeking advice and guidance on when they should file for their Social Security benefits. Using the chart above, this client is 68 years old and past their full retirement age.

Here are the facts:

- The monthly benefit amount they would receive based on the chart is $1,085 per month.

- Your client currently lives on a monthly amount that averages out to about $3,095 per month.

- The deficit per month in income is $2,865.

Where will the extra income for the deficit come from? That is where Income Layers helps. Being able to see the entire picture lets advisors and clients make smarter decisions.

How the Unified Managed Household Creates Retirement Success

LifeYield has the tools to help your firm create the best outcomes for clients using the principles from the Unified Managed Household. Our proprietary technology optimizes strategies for maximizing wealth from tax efficient investing strategies through filing for Social Security benefits. This is what the UMH is all about.

The entire LifeYield suite includes:

- Asset Location: Measure and improve the tax efficiency of a household portfolio while gaining insight on the next best actions for the client to reduce tax drag and maximize returns

- Multi-Account Rebalancing: Works with rebalancing technology already in place within your firm, incorporating the benefits of multi-account tax harvesting and the automated asset location optimization

- Tax-Smart Withdrawals: Execute optimized withdrawals for your clients by selling mislocated assets, minimizing the drift, and identifying the opportunity to harvest losses, increasing tax efficiency

- Tax Harvesting: Works well with the Asset Location, rebalancing, and withdrawal engines to scans all taxable and non-taxable accounts, and identify opportunities to harvest gains or losses

- Social Security+: Help your clients come up with the best strategy and timeline for filing for Social Security benefits

Your firm can use a smart-householding strategy to look across all accounts and holdings so that advisors can see exactly how to improve overall tax efficiency and make the right withdrawal decisions at the right times.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By